The Next Big Thing: ETF Share Classes.

One Portfolio, Two Wrappers. Genius

Whilsts the media has been fixated on the new shiny thing which is Active ETFs, ETF share classes of mutual funds have quietly been building interest in the background.

There is a queue of managers in the US who have already applied to launch ETF share classes and whilst most have yet to play their cards, there is significant interest in Europe from potential new entrants.

Why is all of this happening? Simple

- New distribution channel – Retain legacy mutual fund clients while attracting ETF lovers

- Operational efficiency – gain economies of scale and minimise cost

- Avoid cannibalization of existing mutual fund

- Seed capital – save the need to raise seed capital as would be the case for launching a new fund

- Bypass fund size restrictions – avoid the need to start a new fund from zero and take the time to build aum to make it accessible for certain investors

- Track record – Carry over performance track record of existing fund

As you can see, there’s a lot to like about the share class model, so do not be surprised if it becomes the next big thing.

The Big Picture

Last week was anything but boring— US stocks dropped after the White House announced new 25% tariffs on imported automobiles, breaking the S&P 500’s three-day winning streak and rattling investors far and wide.

Gold hit its seventeenth all-time high this year, as investors have been running to safety. Over in Europe, the euro climbed 4% YTD, putting it on track for its best quarterly performance in a year. If you’re looking for signs of economic confidence— or uncertainity— there’s plenty of both in the current market.

Here are the big stories from last week:

- Elon Musk sold X (formerly Twitter) to his own company, xAI, in a $33 billion all-stock deal, merging his AI ambitions with the platform he once called a “town square for civilization.” Keep your eye on this story, as xAI’s proprietary large language model (LLM) will now be fed anything and everything from one of the most popular social media platforms.

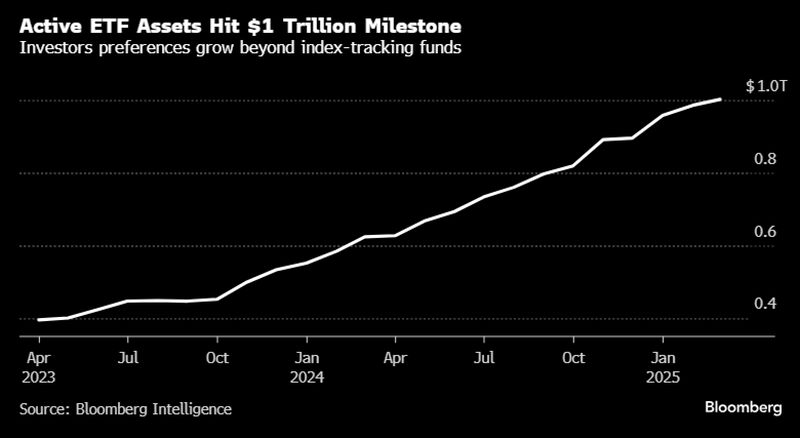

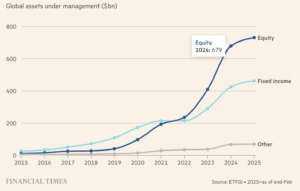

- Global ETF assets under management hit a record $14.6 trillion by the end of 2024, a 27% increase year-over-year, according to a new report by PwC. And actively managed ETFs across the globe went from niche to mainstream— where assets grew by 52% to reach $1.03 trillion globally.

- Major retailers such as Walmart are losing market cap— $22 billion in market value to be exact— after consumer confidence fell to a 12-year low. “Stressed” shopper behavior is rampant in almost all corners of the economy.

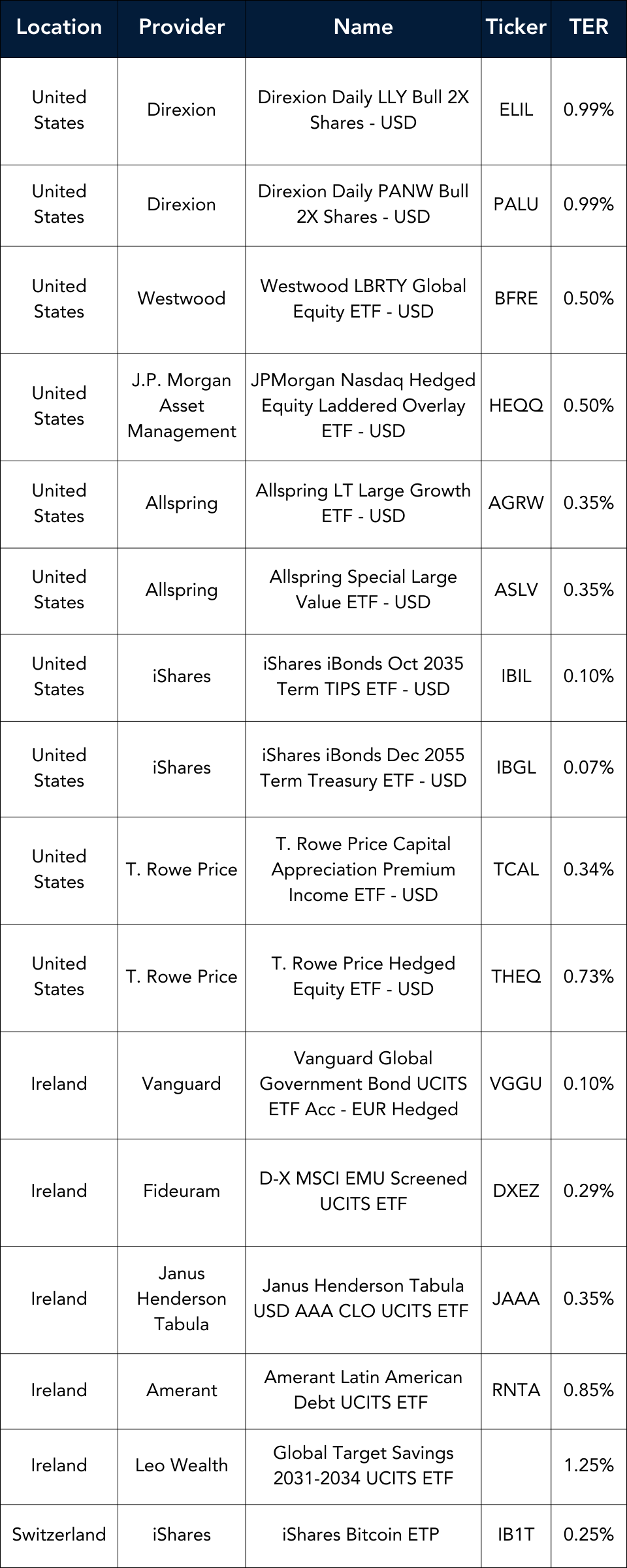

Launches this week

Flows & performance

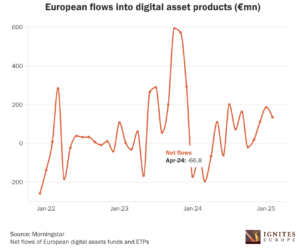

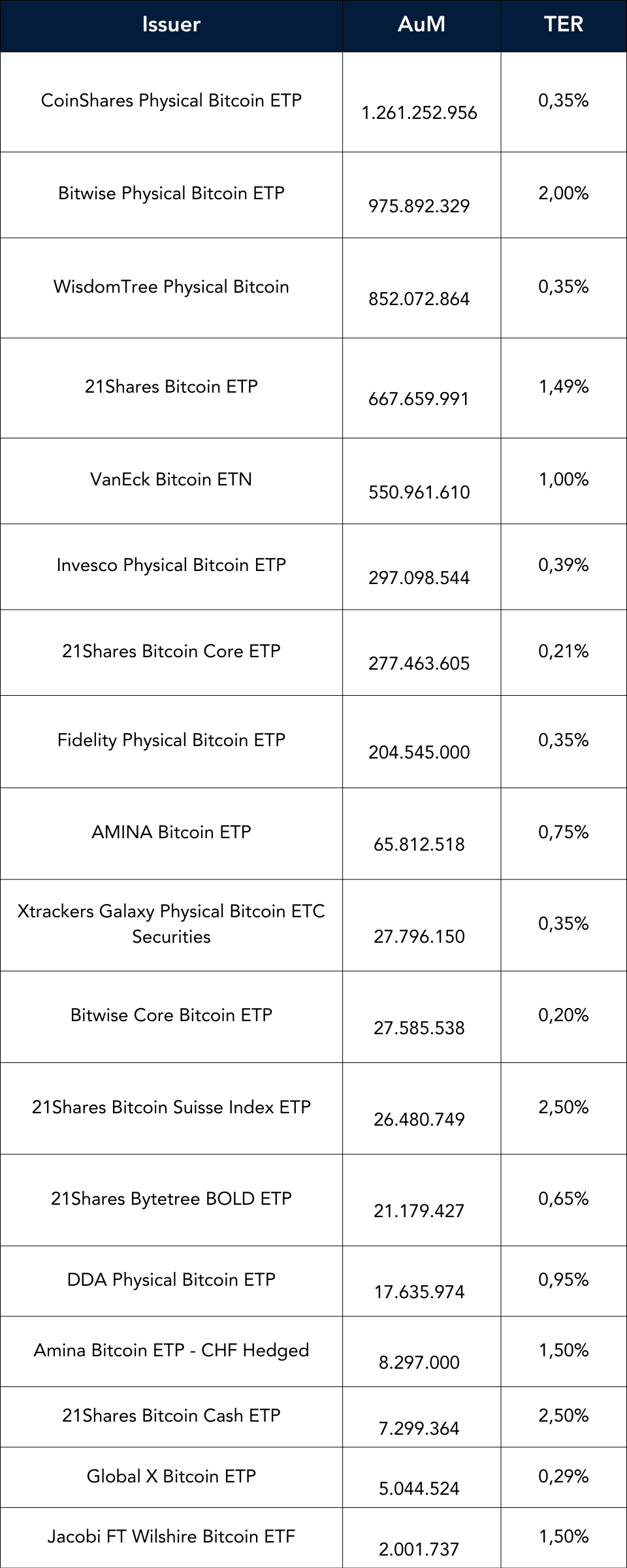

European digital assets funds and ETPs have assets under management of €5.9bn, according to Morningstar data.

Net flows for the products peaked in 2023, reaching €2.2bn, before dropping to a little over €100mn last year. Inflows have picked up over recent months, garnering €430mn over three months to the end of February 2025.

Active ETFs just hit the $1T mark, and now make up 10% of ETF assets, double from just 18mo ago.

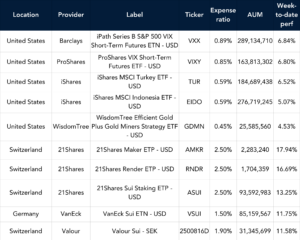

Best Performers US & EU

Listen and Learn

In this episode of Exchange Traded People, we sit down with Stuart Forbes, Head of ARK Invest Europe. From leading self-organized expeditions into uncharted parts of the Amazon to navigating the complexities of asset management, Stu shares his journey from explorer to entrepreneur. He discusses the challenges of launching an ETF business, the realities of competing in a market dominated by giants, and why Europe’s capital markets make fundraising so tough.

Tune in for insights on career growth, disruption in asset management, and the importance of taking risks.

Graph of the Week

Equities have overtaken Fixed Income as the dominant active ETF asset class.

Funds in Focus

This week we profile the newly launched iShares Bitcoin ETP in Europe.

The iShares Bitcoin ETP (IB1T) which is physically backed by bitcoin held through cryptocurrency exchange platform Coinbase, is domiciled in Switzerland, listed on Deutsche Boerse, Euronext Paris and Euronext Amsterdam and comes with a TER of 0.15% but this will rise to 0.25% at year-end when the temporary fee waiver ends.

The US equivalent is also priced at 0.25% and now hold $48bn AUM.

IB1T is entering a crowded space but with a TER of 0.15% they are undercutting the entire market thereby ensuring there is going to be a lot of blood in the market very soon.

Source: Trackinsight

Things of interest

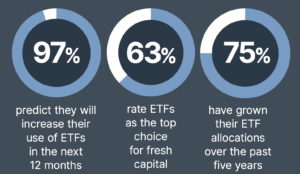

BBH have launched their annual Global ETF survey. Some interesting findings:

Some things that made me raise an eyebrow were:

- 97% of investors plan to increase their exposure to active ETFs in the next 12 months

- 33% plan to shift their passive allocation to active ETFs over the next 12 months.

Such activity would end up making the passive ETF market redundant and the industry becoming overrun with active ETFs. I mean, I know everyone is infatuated with active these days but I think this is taking it a bit too far

Investor appetite for digital assets is growing

BlackRocks latest People & Money crypto spotlight report reveals a powerful trend: investor appetite for digital assets is growing.

BlackRock’s report suggests a growing interest in cryptocurrency, particularly among younger investors and women, with digital platforms and ETFs driving this trend.

Growing Crypto Interest:

BlackRock’s research indicates a significant increase in cryptocurrency ownership, especially among women (with an 18% increase year-on-year) and younger investors.

Digital Investing and ETFs:

The rise of digital investing and the popularity of ETFs are key drivers of this trend, with a large percentage of younger investors accessing ETFs through digital platforms.

Specific Market Trends:

In Portugal and the Netherlands, investors show a preference for cryptocurrency over stocks and shares.

Portugal (43%) and the Netherlands (40%) have the highest crypto ownership rates in the surveyed countries.

The UK, Portugal, Denmark, and the Netherlands lead in digital ETF investing.

South African white label provider Precient is to bring their platform to Europe and compete with the likes of Hanetf, Waystone and soon to launch Citi and Allfunds.

It’s an interesting approach as not clear what their USP is going to be. But the more choice the market has the better I guess especially if rumors about Goldman Sachs closing down their white label platform turns out to be true.

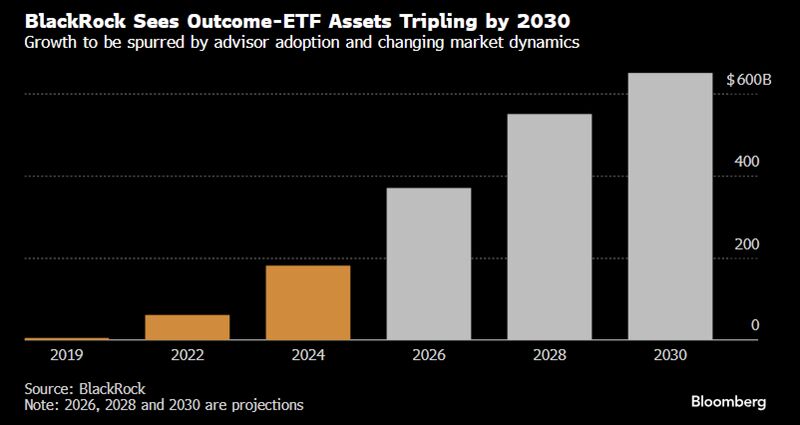

BlackRock is forecasting a boom in Boomer Candy (options-based ‘protection’ strategies incl premium income, buffers) ETFs expecting them to triple to $650b in next five years

New Entrants and New Plans

Another new entrant to the European ETF market. This time its South Florida-based RIA and broker dealer Amerant Investments who are bringing an actively managed Latin American debt ETF to market via HANetf. I always wonder what firms like this hope to achieve by such a move. Is it a role of the dice – lets launch one and see how it goes or maybe they have some seed client who asked for the launch?

Allfunds have given some insight into their ETF plans in Europe. “We will be able to support issuers in launching their ETFs, connect them to the largest distribution platform and provide them with the tools to scale, such as our cutting edge data-driven solution, Allfunds Navigator. The key missing piece in the ETF business in Europe is distribution”

I certainly can’t disagree with that one. Assuming things go to plan then Allfunds have the potential to have a serious impact on the European ETF ecosystem.

JPMorgan Asset Management is in discussions with Chinese regulators and local stock exchanges to allow it to launch active ETFs in the market.

JPM has launched four standard index-linked ETFs in China in just over two years since it bought out its local fund joint venture but it sees the opportunity to add an active tilt to its local ETF range as a way to win market share off dominant local players.

Active ETFs are still prohibited in China so first step will be to twist the arm of the regulator I guess.

Career corner

Movers and Shakers

- Joe Miraglia has joined SSGA in NY as ETF Asset manager and Hedge Fund Sales. He joins from Citi.

- Jason Acab has joined iShares in Arizona as a Sales Executive. He joins from Franklin Templeton.

- Pablo Bernal is now head of Spain for Vanguard. He relocated from their Mexico office.

- Schroders has appointed Jonathan Ulinder as an ETF capital markets specialist. He is an internal hire having previously worked as an implementation portfolio manager.

On the Move

US featured Opportunities

Index Licensing Sales – New York: Help grow the Index business in the US as part of our dynamic and growing Index Licensing Sales team by working with investment product issuers to bring new innovative investment products to market.

European Featured Opportunities

Product Development Specialist – Munich or London: Play a key role in developing and maintaining a unique product suite by sourcing and validating new product ideas across a variety of asset classes and managing the product life cycle from product design to launch and ongoing product enhancements.

Tip of the week

This week I want to share a new career platform we have launched

ETFcareer.com is the ONLY career platform dedicated 100% to the ETF industry, globally and is focused on supporting the needs of those looking to accelerate their ETF careers and those looking to employ and nurture best in class talent for their organisation.

What it offers:

Dedicated ETF Jobs Board – this is where the ETF ecosystem posts their open roles

Career Content — ETF specific content for supporting career development

Training — online training courses covering all aspects of the ETF ecosystem

Coaching database — Want to find a coach to work 1-2-1 with. Look no further

Mentor database — Fancy a mentor. Find them here

Salary surveys — Compare your comp to your peers

And more to come

Our goal is to make this the go-to place for ETF career related information.

Please check out our site and help us achieve that goal.

About us

2025 Global ETF Salary Survey – Coming Soon

Career growth. Work-life balance.

This year, we’re going deeper than ever.

Our annual ETF Industry Salary Survey is about to launch, providing unparalleled insights into pay trends, bonuses, and career trajectories across the industry.

The full report will be a paid resource—but those who participate will receive access to key findings and exclusive insights.

Your input shapes the industry’s understanding of compensation. In return, you’ll gain access to data that matters.

Stay tuned – the survey opens soon.

Join the Blackwater Referral Program & Earn Rewards for Your Network

Unlock a simple way to generate extra income while helping professionals and businesses connect. By becoming an affiliate member of the Blackwater Referral Program, you can leverage your network and earn a percentage of our placement fees.

How It Works

- Refer a Candidate – If you introduce us to a job seeker who we successfully place, you’ll receive 5% of the fee earned.

- Refer a Company – If you connect us with a company that becomes a client, you’ll receive 10% of the fee earned.

It’s a win-win: you help expand opportunities, and we reward you for it. No effort, just rewards.

Start earning today – get in touch to learn more.