Are ETF salaries about to defy the market—or sink with it?

Are ETF salaries about to defy the market—or sink with it?

Markets have once again created a challenging environment which no doubt will put ETFs to the test again.

While 2024’s record-breaking flows were buoyed by strong market tailwinds, 2025 has brought a more complex and challenging environment. So talk of 2025 setting new records may prove premature.

Volatility is back, sentiment is fragile, and ETF strategies are once again being put to the test.

Time for us all to buckle in and hold onto our hats.

On a more optimistic note, we’re about to launch the 2025 Global ETF Salary Survey. As always, the more professionals that contribute, the more meaningful the data becomes.

If you’re looking to benchmark your compensation against your peers — or just get a clearer picture of how the industry’s evolving — this is your opportunity.

The Big Picture

Last week was a brutal one in every corner of the global economy— and if you were hoping for a calm Q2 kickoff, you better think again. US markets got smoked following a fresh wave of tariffs from the White House, where the S&P 500 posted its second-largest market cap wipeout in history.

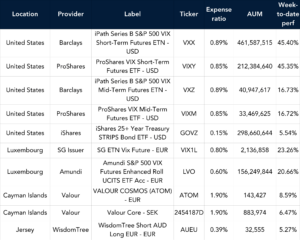

The VIX volatility index spiked to its highest level since last summer, while Europe’s Stoxx 600 and Japan’s Nikkei 225 both tumbled, wiping out a significant chunk of YTD gains— where Japan officially entered a bear market, down 21% from its highs.

Commodities (oil/gas, precious metals and everyone’s favorite cryptocurrencies) saw their worst week YTD. Meanwhile cash suffered as well— the US dollar had its biggest daily drop in nearly three years, and the euro and yen soared.

Oh, and to top it all off: layoff announcements are at their highest levels since the COVID crash of 2020. Be careful out there, it’s getting ugly.

Tariffs were the BIG story from last week, and here’s the latest:

- Trump’s ‘Liberation Day’ turned into ‘Liquidation Day’ as he announced sweeping new tariffs in a fiery “economic independence” speech that spooked investors and tanked global markets.

- The White House is signaling it’s open to negotiations, though there’s no sign of a formal rollback just yet.

- Global markets may not feel the full impact for months, but economists warn these tariffs are piling stress on an already fragile world economy.

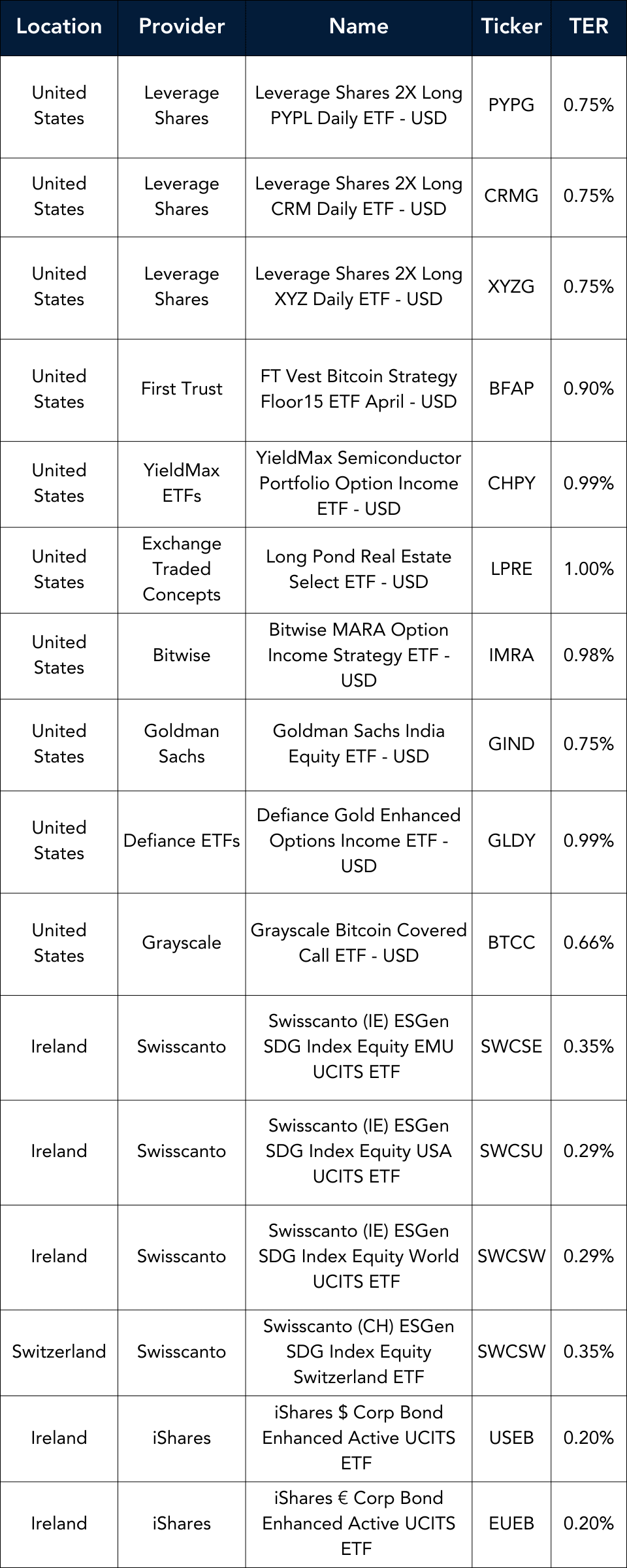

Launches this week

Flows & performance

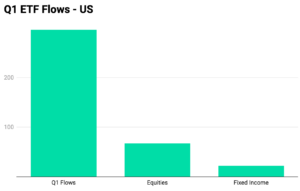

In the US, growth biased global stocks fell 4% in March. But bonds, gold, and commodities rallied as investors sought hedges for falling growth and rising inflation:

- $296 billion of ETF inflows in Q1 2025 set a Q1 record, topping the $248 billion from Q1 2021 and puts ETFs on pace for $1.3 trillion for the full year

- Equities took in $67 billion in March, but US sectors had $3 billion of outflows as investors derisked and sought opportunities overseas. European exposures had $6 billion of inflows, their second-most ever

- Bond ETFs took in $22 billion in March, fuelled by $7 billion into ultra-short government bond ETFs and $2 billion into inflation-linked bond ETFs with investors seeking defence and inflation protection. Gold ETFs had $6 billion of inflows.

ETFs also continue to break records for the number of funds to launch, with a total of 89 in March. This makes 245 for the first quarter of 2025, compared to 148 in the first quarter of 2024. This is a 66% increase year-over-year.

Bitcoin ETFs and other top performers from 2024 have experienced dramatic declines in the first quarter of 2025, highlighting the risks of chasing the prior year’s winners.

Among the 10 best-performing, non-leveraged ETFs in 2024, cryptocurrency-themed funds dominated the list, with returns ranging from 109% to 213%. However, these same stellar performers faced headwinds in 2025’s first quarter.

Investors who bought into these top-performing funds at the end of 2024 would have experienced losses in just three months, with declines ranging from 11% to over 32%, underscoring the perils of chasing performance and the volatile nature of thematic investments.

Bitcoin ended the first quarter of 2025 down about 11.7% from the year’s start, marking its weakest first-quarter performance since 2018. Ethereum fared even worse, with its price plummeting approximately 45% in the quarter, creating a challenging environment for cryptocurrency investors.

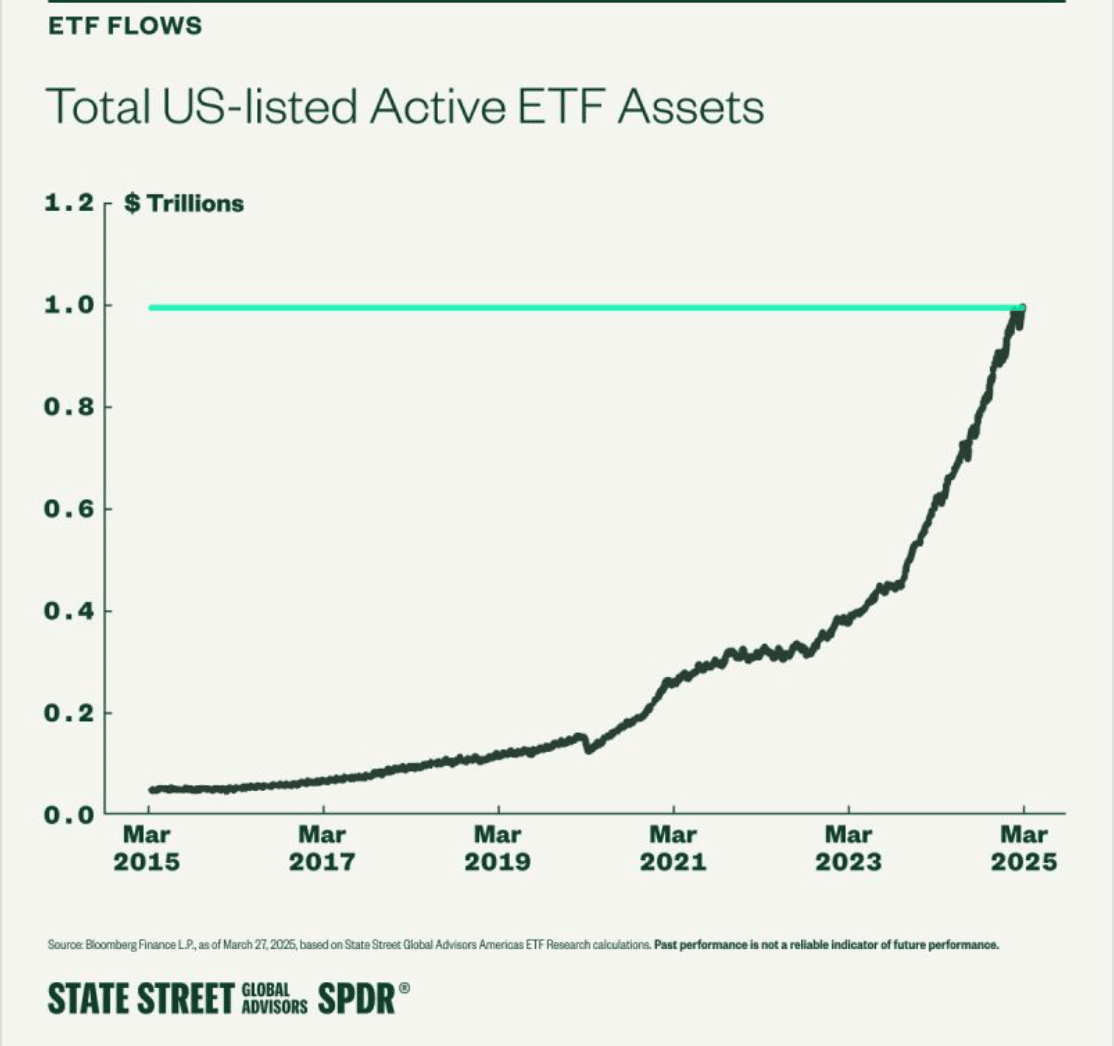

Total US-listed active ETF assets under management surpassed $1 trillion for the first time ever on March 25, a new milestone in their ever-accelerating adoption timeline.

While market returns forced assets lower in subsequent days, crossing the $1 trillion Rubicon points to a positive path ahead.

On pace for a record $400 billion of inflows this year, active ETFs will most definitely surpass $1 trillion by the end of 2025 and be well on their way to $2 trillion by the end of 2026.

Or will there? If markets continue their downward trajectory who knows how the year might end up.

Best Performers US & EU

Listen and Learn

In this episode of Exchange Traded People, we chat with Blair Abbott, now with Mirae Asset Global Investments in South Korea. Blair didn’t always know he’d land in finance-he once dreamed of becoming a vet, dabbled in freelance gigs, worked in the family business, and tried a few paths before finding his footing in financial services at Franklin Templeton back in Toronto.

Blair shares his reflections on how the industry -and his own mindset -has evolved over the years. From learning the importance of time management to embracing the non-linear nature of careers, he offers thoughtful advice for anyone navigating their own journey. He reminds us that it’s often more helpful to figure out where you don’t want to go, rather than trying to map out every step of where you do.

Tune in for a refreshingly honest conversation about growth, uncertainty, and why staying open to opportunity might just be your best strategy.

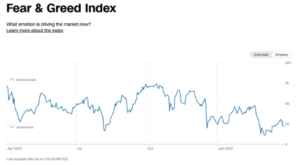

Graph of the Week

In his 1986 chairman’s letter to investors, Warren Buffett noted, “We simply attempt to be fearful when others are greedy and to be greedy only when others are fearful.”

Well, according to the Fear & Greed Index, 2025 is the time for us to be greedy.

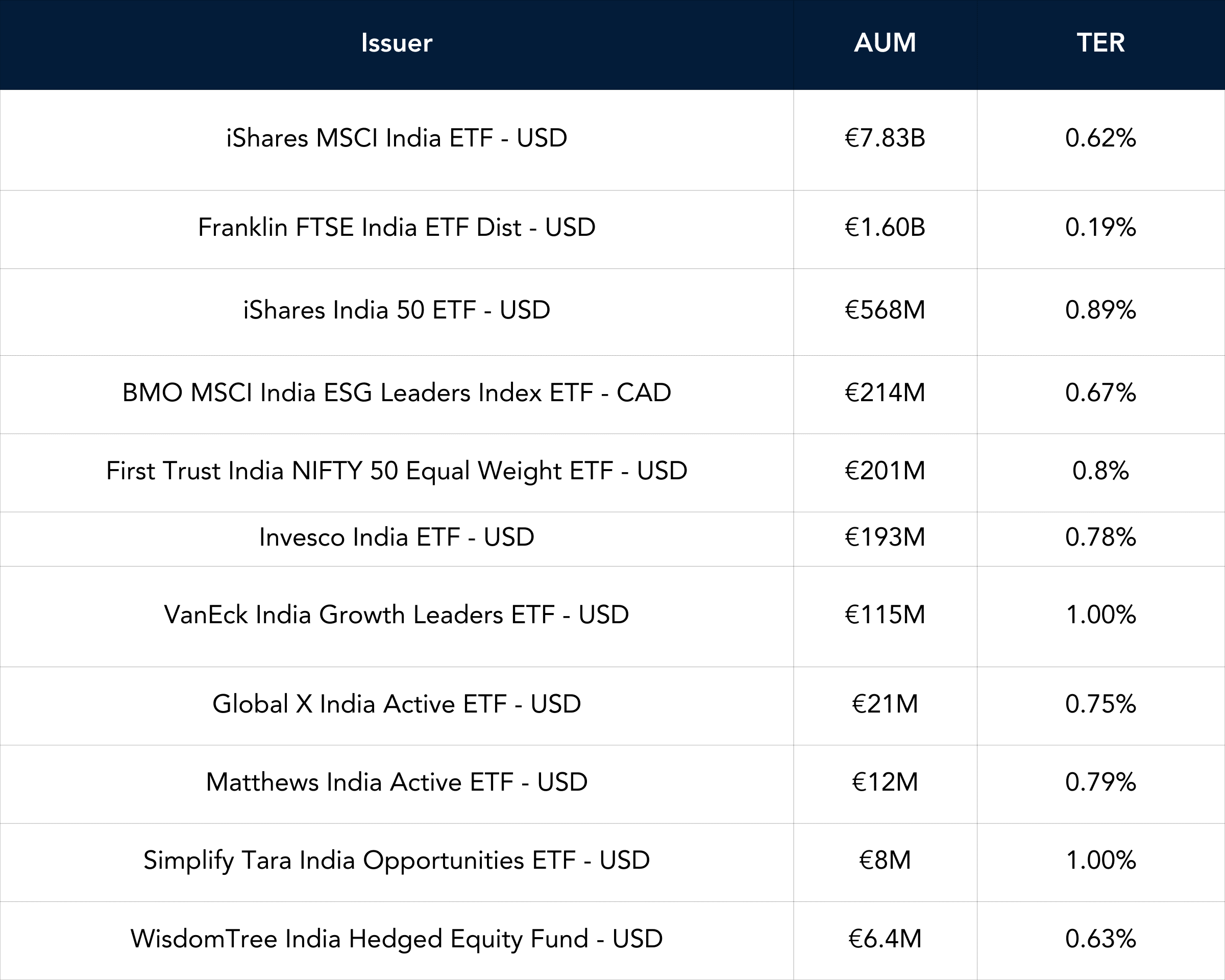

Funds in Focus

Goldman Sachs has added to their growing lineup of active ETFs with the launch of the Goldman Sachs India Equity ETF (GIND).

The fund is priced at 0.75% which puts it on the middle of the pack vs its peers (bearing in mind though the fund is actively managed).

India recently overtook China as the world’s most populous country, and it’s flexing that demographic muscle with a projected GDP growth of 6.5–7% for 2025, according to the IMF and World Bank.

Add in a booming middle class, record-breaking smartphone and internet penetration, and a massive push in manufacturing via the “Make in India” initiative, the growth runway looks solid.

Things of interest

The global head of products at Xtrackers has warned that some new entrants to the active exchange traded funds space risk “destroying” the ETF brand because they do not have the appropriate infrastructure in place.

Michael Mohr said DWS employed dozens of people and spent “millions” a year on its ETF infrastructure, stating “New entrants to this market must do the same thing. They have to focus on technology, data and infrastructure to really get it right. “The ones who don’t get it right should think twice, because it is a risk to themselves, to their existing business and reputation”

Is he taking a pop at issuers who enter via the white label route by any chance?

BlackRock has obtained approval from the UK financial regulator to carry out cryptocurrency-related business in the local market.

BlackRock International, a UK-regulated entity of the world’s largest asset manager, has been listed on the Financial Conduct Authority’s database of registered crypto-asset firms with effect from April 1.

P Morgan Asset Management has become the second investment house to enter the fledgling active ETF market in Singapore.

The firm has registered three of its flagship income active ETFs in the city-state, but stopped short of listing them on SGX while it gauges interest. The registrations with the Monetary of Singapore enable JPMAM to promote the funds, which are London-listed, to domestic retail investors.

Active ETFs have got off to a slow start in Singapore since they were permitted by MAS in December 2023. Only one fund has been launched in the first 15 months, the Lion-Nomura Japan Active ETF, which was quickly listed on SGX in January 2024 and amassed a modest $37m.

Career corner

Movers and Shakers

- Andrew Deegan has joined Virtus ETFs as a Capital Markets Specialist. He joins from Pacer ETFs.

- Charlie Macpherson has joined Robeco as ETF business manager in London. He was previously head of ETFs at Circa5000.

- Mo Sparks has joined Direxion in Boston as Chief Product Officer. He joins from Raymond James after only 9 months in the role.

- Josh Hinderliter has joined ETF Architect as General Counsel in Chicago. He joins from US Bank.

On the Move

Looking to take the next step in your ETF career?

ETFcareer.com connects top talent with the industry’s leading firms. Whether you’re just starting out or seeking a senior-level role, our curated job board features opportunities tailored to your expertise.

Tip of the week

WARNING: Playing It Safe Is Damaging Your Career

Let’s be real — playing it safe is just another way of saying “I’m scared.”

- Scared to fail.

- Scared to stand out.

- Scared to get it wrong.

But the thing is: nobody remembers safe.

- Safe doesn’t get you hired.

- Safe doesn’t get you promoted.

- Safe doesn’t build anything worth talking about.

Every time you shrink back instead of stepping up, you’re trading long-term growth for short-term comfort. Just don’t act surprised when your career plateaus.

About us

Join the Blackwater Referral Program & Earn Rewards for Your Network

Unlock a simple way to generate extra income while helping professionals and businesses connect. By becoming an affiliate member of the Blackwater Referral Program, you can leverage your network and earn a percentage of our placement fees.

How It Works

- Refer a Candidate – If you introduce us to a job seeker who we successfully place, you’ll receive 5% of the fee earned.

- Refer a Company – If you connect us with a company that becomes a client, you’ll receive 10% of the fee earned.

It’s a win-win: you help expand opportunities, and we reward you for it. No effort, just rewards.

Start earning today – get in touch to learn more.