The Democratisation of Paradigm Shifts

The ETF industry sure loves the use of jargon.

Apparently, everything is being “democratised” in ETFs these days (private credit being the latest one) and there are paradigm shifts all over the place e.g. the most recent being JPMorgan sees a paradigm shift to active management in ETFs.

Once upon a time, a paradigm shift meant something big — the creation of ETFs, the invention of cryptocurrencies. Now it means… a new share class or an ESG fund with a rebranded logo.

In asset management, we don’t just jump on trends anymore — we hold a conference about it, slap “democratisation” on the invite, and call it innovation.

To think of it another way. If everything is a paradigm shift, then nothing is. Right?

The Big Picture

Markets Climbed, Trade Winds Shifted, and Big Money is on the Move

It was another eventful week across global markets: US stocks posted three straight winning sessions boosted by signs of progress on trade deals, while the UK’s FTSE 100 extended its rally to nine days in a row— its best streak since 2019. Meanwhile, gold hit a new all-time high midweek before suffering its worst daily drop of 2025 on Thursday. Norway’s $1.7 trillion sovereign wealth fund is betting big on slumping US stocks, taking a contrarian stance amid lingering recession fears.

OpenAI is projecting 1,000% revenue growth over the next five years, showing AI hype isn’t even close to slowing down. US spot Bitcoin ETFs are thriving, posting a 17,886% surge in weekly net flows compared to their early days— and across multiple funds— showing that investors have more options other than BlackRock’s big bad IBIT.

Here are the big stories from last week:

- Apple announced it will shift all US-bound iPhone assembly to India, stepping away from China amid escalating trade tensions. All eyes are on India for its projected growth— a standout emerging market and investor darling.

- European Central Bank President Christine Lagarde signaled that the 2% inflation goal is within sight but warned that global tariffs could complicate the recovery

- New data published last week indicates that the 19 richest US households added a staggering $1 trillion in wealth last year— highlighting just how concentrated American financial power is today.

Launches this week

Flows & performance

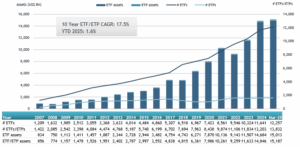

ETFGI reports record Q1 net inflows of US$463.51 billion into the global ETFs industry.

- Record Q1net inflows of $463.51 Bn, while the second highest Q1 net inflows were $397.51 Bn in 2024 and the third highest Q1 net inflows were of $360.72 Bn in 2021.

- Net inflows of $158.81 Bn during March.

- 70th month of consecutive net inflows.

- Assets of $15.19 Tn invested in the ETFs industry globally at the end of March, below the record high assets of $15.50 Tn at the end of February 2025.

- Assets increased 1.6% YTD in 2025, going from $14.85 Tn at end of 2024 to $15.19 Tn

European Gold ETP market on the way to reach $150bn in AUM. Current AUM of circa $138bn, strong positive flows of $4.7bn YtD.

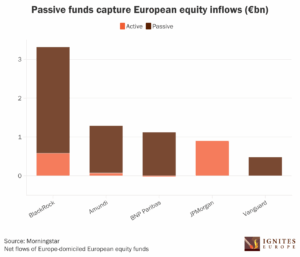

BlackRock and Amundi attracted the largest inflows into European equity funds last month as investors shifted away from US stocks amid concerns over the prospects for the world’s largest economy.

European equity funds had €9.8bn of inflows in March, marking their strongest month since May 2017, according to Morningstar data.

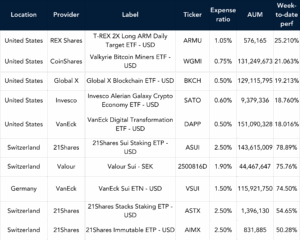

Best Performers US & EU

Listen and Learn

Mario Bonaccorso, founder of Investlinx, joins Exchange Traded People to share his unconventional path from telecom engineering to founding an active ETF investment firm.

He reflects on his early fascination with technology, a patent-winning stint at Qualcomm, and the pivotal decision to shift into the business world through McKinsey. Mario talks about the power of networking, the importance of taking risks early, and why launching Investlinx gave him the perfect balance between innovation and lifestyle.

His biggest insight? Networking isn’t just about connections—it’s a long-term investment in your career.

Graph of the Week

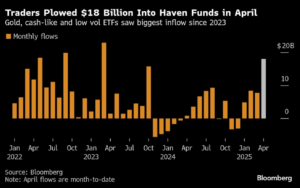

Gold and cash-like ETFs are sucking up money as investors seek safety.

Funds in Focus

Last week I interviewed the CEO of a small ETF manager in Europe called Investlinx ETF for our podcast. The episode is coming out next week so check it out. Investlinx have only 2 ETFs, the Investlinx Balanced Income UCITS ETF and the Investlinx Capital Appreciation UCITS ETF. Both are prices at 0.85% and listed on Borsa Italiana.

What makes Investlinx interested is

- They chose to build their own infrastructure rather than going down the white label route

- The funds are high conviction active – no systematic / enhanced index mumbo jumbo

- They launched mutual fund share classes off the back of the ETFs

- They have embraced transparency and actually believe it has helped rather than hindered them.

For a small issuer there’s a lot others could learn from Investlinx.

Things of interest

Recently we ran a poll asking people how satisfied they were with their bonus for 2025. Below are the results. Looks like nearly 60% of people are not that pleased even though 2024 was the best year ever for ETFs. A sign that the spoils are not being shared amongst the people who made it happen?

More than a third of Taiwanese investors now allocate exclusively to ETFs while the proportion of the population with no experience investing in funds has fallen to just 18%, according to a new survey conducted by the Securities Investment Trust and Consulting Association.

Investors aged 30 to 50 are most proactive in ETF investments, with 39 % holding both ETFs and mutual funds. Respondents aged over 50 leaned more heavily towards traditional mutual funds.

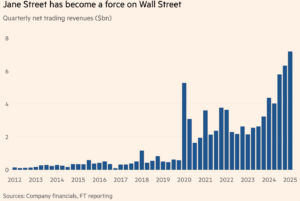

Jane Street’s trading revenues almost doubled last year

Jane Street’s trading revenues almost doubled last year and boomed during the tariff-induced turmoil of the first quarter of 2025, as it generated profits rivalling those of Goldman Sachs and Morgan Stanley.

The group, which operates in equity, option and fixed-income markets, generated $20.5bn of net trading revenues in 2024, up 94% from 2023.

Trump Media and Technology Group Corp, operator of the social media platform Truth Social, the streaming platform Truth+, and the FinTech brand Truth.Fi, has signed a binding agreement to partner with US crypto trading platform Crypto.com and asset management firm Yorkville America Digital to launch a series of ETFs and ETPs through the Truth.Fi brand.

The ETFs, made available through Crypto.com’s broker dealer Foris Capital US LLC, are expected to comprise digital assets as well as securities with a Made in America focus spanning diverse industries such as energy, the announcement says.

BMO is pulling out of its fund partnership with U.S. tech investor Cathie Wood. BMO in Canada announced last week that it was terminating three BMO mutual fund ARK investments, as well as the three ETF versions – all six BMO funds were managed by Ark. Investors in the BMO ARK Genomic Revolution Fund, BMO ARK Innovation Fund and BMO ARK Next Generation Internet Fund will be able to redeem and trade their investments up until July 7.

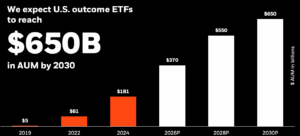

BlackRock are bullish on Outcome ETFs. The company forecasts U.S. outcome ETF assets under management will more than triple to $650 billion by 2030, from $181 billion in 2024, as more advisors and investors turn to these strategies. Expect them to launch a bunch of such products over the coming months no doubt.

Career corner

Movers and Shakers

- Flow Traders have announced that CEO Mike Kuehnel is stepping down in order to pursue a new opportunity.

- Helen Hayes head of iShares in Canada, has left the firm, according to Bloomberg. The move comes amid a broader restructuring at BlackRock. The memo did not say that Hayes would be replaced, Bloomberg reported, adding that the memo said, Hayes “expressed her intention to pursue new opportunities outside of the firm.”

- Euronext has appointed Liz Wright as head of index sales. She joins from Morningstar.

On the Move

Looking to take the next step in your ETF career?

ETFcareer.com connects top talent with the industry’s leading firms. Whether you’re just starting out or seeking a senior-level role, our curated job board features opportunities tailored to your expertise.

Tip of the week

Making your boss look good is always a great way to get on with them

And hopefully by default them looking favourably upon you. Here are some ideas to achieve that.

- Understand Their Priorities: Know what success looks like for them and align your work to support those goals.

- Deliver Excellence: Consistently produce high-quality work that reflects well on your team—and by extension, your boss.

- Be Proactive: Anticipate challenges or opportunities and address them before they escalate, showcasing your boss’s leadership in action.

- Promote Their Vision: Speak positively about your boss’s ideas and help bring their strategy to life.

- Be a Problem-Solver: Handle issues independently where possible, so they can focus on higher-level priorities.

- Keep Them Informed: Provide concise updates to avoid surprises and show you’re always on top of things.

About us

Join the Blackwater Referral Program & Earn Rewards for Your Network

Unlock a simple way to generate extra income while helping professionals and businesses connect. By becoming an affiliate member of the Blackwater Referral Program, you can leverage your network and earn a percentage of our placement fees.

How It Works

- Refer a Candidate – If you introduce us to a job seeker who we successfully place, you’ll receive 5% of the fee earned.

- Refer a Company – If you connect us with a company that becomes a client, you’ll receive 10% of the fee earned.

It’s a win-win: you help expand opportunities, and we reward you for it. No effort, just rewards.

Start earning today – get in touch to learn more.