What is hindering UK retail investor growth?

Given the long bank holiday weekend, a brief newsletter today with no fund launches in Europe and just a handful last week in the U.S.

Interesting UK retail survey conducted by Wisdomtree confirms the need for more investor education.

Fund Launches and Updates

EMEA

DWS is planning to switch the index on the Xtrackers MSCI EM Asia Swap UCITS ETF (XMAS) and the Xtrackers AC Asia ex Japan Swap UCITS ETF (XAXJ) to ones that track ESG metrics.

As a result, both ETFs will have ESG added to their names while the total expense ratios (TERs) – 0.65% for both products – and respective tickers will remain the same. Link

Leverage Shares has renamed its nine short, leveraged and one-to-one ETPs offering exposure to three of Cathie Wood’s popular thematic ETFs amid a “legal tussle” over intellectual property. Link

More benchmark switches as State Street Global Advisors plans to switch the SPDR S&P 500 ESG Screened UCITS ETF (SPPY) from tracking the S&P 500 ESG Exclusions index to the S&P 500 ESG Leaders index.

As a result of the switch, the ETF will change its name to the SPDR S&P 500 ESG Leaders UCITS ETF under the same ticker.

The ETF will continue to be labelled Article 8 under the Sustainable Finance Disclosure Regulation (SFDR). Link

AMERICAS

Fidelity Investments will be launching the Fidelity Crypto Industry and Digital Payments ETF (FDIG) and the Fidelity Metaverse ETF (FMET).

The two new self-indexed thematic ETFs expand Fidelity’s line-up into the crypto and metaverse industries and have expense ratios of 0.39%. Link

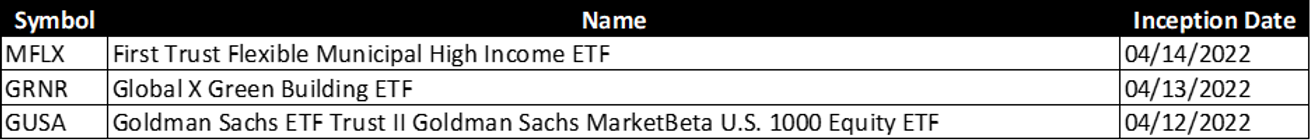

Full List of U.S. ETF Launches:

Fund Flows and Trading Volume

Sensitive to interest rate changes, a number of longer-term treasury ETFs are experiencing record drawdowns.

BlackRock’s $19 billion iShares 20+ Year Treasury Bond ETF (ticker TLT) has fallen almost a third from an all-time high in August 2020 which is more than the previous record drawdown seen between 2008 and 2010. Link

Noteworthy

According to a survey of 1,000 UK retail investors by WisdomTree, only 22% invest in ETFs and unsurprisingly, lack of education is cited as the main barrier to investing.

Of those who do not invest in them, 34% said it was due to not understanding them and 19% of respondents indicated they have never heard of ETFs/ETPs.

Additional reads

BNY Mellon ETF Services announces two new ETF centre solutions Link

Thematic ETFs yet to be launched in Europe Link