Private Markets – a poison chalice for the ETF industry?

The ETF industry’s push into private markets — from credit to equity — is bold, but it’s not without serious reputational risk.

ETFs are built on daily liquidity, price transparency, and easy access. Private assets are… the opposite. Trying to merge the two may work in a calm market, but what happens when stress hits?

If one of these new products gates redemptions or blows up, the damage won’t stop at the issuer — it could shake investor trust across the entire ETF ecosystem.

Is this a poison chalice? Maybe. Yet the temptation to offer yield and diversify product lines seems to be too strong to ignore. The question now isn’t if these products will launch — it’s whether the industry is ready to handle the fallout if one goes wrong.

Some doors, once opened, can’t be closed.

The Big Picture

Central Banks are Making Moves, Tariff Talks are Back on the Table and Bitcoin > Amazon

Global markets were mostly steady last week, with US stocks closing flat on Friday as all eyes turned to US–China trade talks over the weekend after a surprise US-UK trade agreement was established.

Both the US and China agreed to pause tariffs for 90 more days, offering a temporary sigh of relief. Over in Europe, Germany’s DAX hit a fresh record high. The US Dollar posted its biggest weekly gain since March.

Meanwhile, Bitcoin cracked $100,000, and Ethereum surged 14%, reclaiming some ground but still far off of its 2024 highs.

Here are the big stories from last week:

- The Bank of England cut rates to 4.25%, citing tariff drag on growth, while the US Fed held steady, warning of persistent economic risks and inflation concerns— both US and UK stocks climbed after a surprise US–UK trade agreement revived optimism ahead of the next phase of China negotiations.

- Bitcoin overtook Amazon in market value, hitting a $2.015 trillion market cap, making it the fifth-largest asset globally— a truly remarkable feat that has crypto bulls rejoicing and investors taking notice of the current rally.

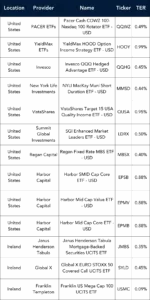

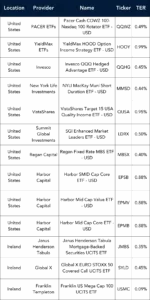

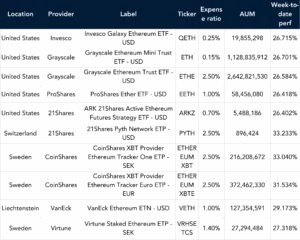

Launches this week

Flows & performance

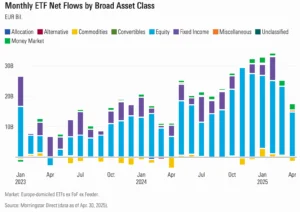

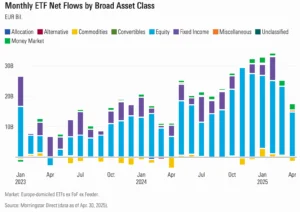

In April, European investors poured €16.2 billion into ETFs, shifting money from the US to Europe. Even though the headline figure seems encouraging, this is the lowest monthly result in terms of flows since April 2024.

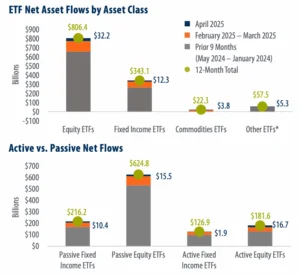

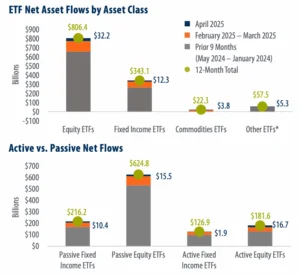

U.S.-listed ETFs saw $53.7 billion in net inflows in April, pushing total assets to $10.3 trillion. Equity ETFs led with $32.2 billion, split between active ($16.7B) and passive ($15.5B) strategies. Fixed income ETFs added $12.3 billion, while commodities ETFs brought in $3.8 billion, driven by a $3.9 billion surge into precious metals funds.

Gold and Bitcoin are two of the most popular safe-haven assets

Gold and Bitcoin are two of the most popular safe-haven assets, but they’re having very different years in 2025 depending on what you’re measuring.

In terms of price performance, it’s a rout. The SPDR Gold Shares (GLD), the largest gold ETF, is up 29% year to date, while the iShares Bitcoin Trust (IBIT), the leading U.S.-listed spot Bitcoin ETF, has gained just 4%.

But when you flip from price charts to ETF flows, the story changes. IBIT has pulled in more than $6.9 billion in new investor money this year, edging out GLD, which has brought in $6.3 billion, according to data from FactSet.

Both ETFs are the flagship products in their respective categories—with assets under management of $102 billion for GLD and $59 billion for IBIT. While gold is clearly outperforming in the market, Bitcoin is winning the ETF popularity contest, at least based on the inflows for these two massive funds.

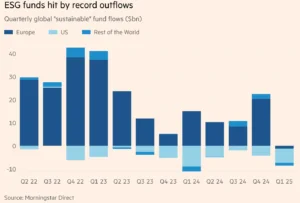

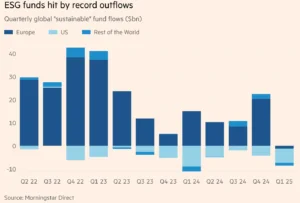

Investors pulled a record amount from “sustainable” funds in the first quarter of the year, in an early sign that the US backlash against environmental, social and governance-based investing is going global.

While US investors cut their exposure to sustainable mutual and exchange traded funds for a 10th straight quarter, Europeans were net sellers for the first time on record in data going back to 2018, pulling out $1.2bn, according to data from Morningstar.

Investors Pivot to Asia Amid U.S. Tariff Turmoil – Global investors are shifting focus to Asian equity ETFs, with $8.45 billion in net inflows over the past three weeks—the highest in seven months. This comes as U.S. equity funds experienced $43.5 billion in outflows, reflecting concerns over new tariffs and a crowded U.S. market.

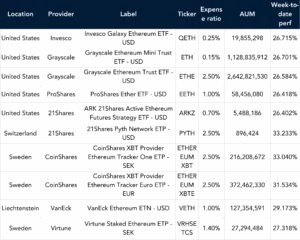

Best Performers US & EU

Listen and Learn

In Case You Missed It: From the Amazon to Asset Management

This week on Exchange Traded People, we revisited the incredible journey of Stuart Forbes, Head of ARK Invest Europe. Before launching ETFs, Stuart was exploring uncharted territories in the Amazon—literally. His path from expedition leader to ETF entrepreneur is a story of bold moves, clear vision, and relentless problem-solving.

In this episode, Stuart opens up about what it takes to build an ETF business from the ground up, the unique hurdles in Europe’s capital markets, and how to stand out in a space dominated by industry titans. Whether you’re navigating your own career or building something new, his insights on risk, resilience, and innovation are worth a listen.

Listen now and get inspired by a different kind of portfolio adventure.

Graph of the Week

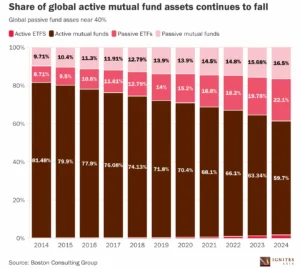

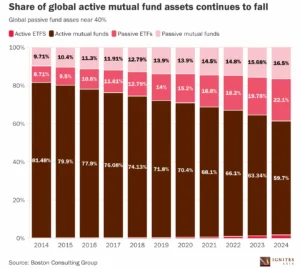

In 2024 active funds saw US$100bn in outflows compared with US$1.6tn in net inflows for passive funds, though much of the outflows were from North American investors.

Funds in Focus

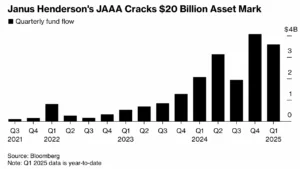

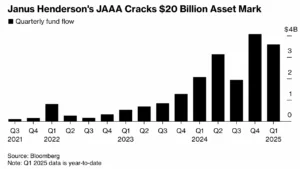

The Janus Henderson AAA CLO ETF (JAAA) is the heavyweight champ of the CLO ETF world. Launched in October 2020, it’s ballooned to over $20.5 billion in assets under management as of May 2025, making it the largest CLO ETF globally.

JAAA offers investors exposure to high-quality, floating-rate AAA-rated collateralized loan obligations, an asset class that was once the playground of institutional investors. With an expense ratio of 0.20%, it’s competitively priced, especially when compared to peers like the PGIM AAA CLO ETF (PAAA), which charges 0.25%. JAAA is actively managed by a seasoned team at Janus Henderson, aiming to deliver attractive yields without stretching duration.

For European investors, a UCITS-compliant version, JAAA LN, is listed on the London Stock Exchange with a slightly higher fee of 0.35%.

The fund has a TER OF 0.35% and is listed on NYSE.

Things of interest

Investors wanting to go green in the UK are hitting a price wall: sustainable investing is mostly stuck in expensive active funds, thanks to new FCA rules. Since April 5, funds using labels like “sustainable” or “impact” must adopt one of four official FCA-approved labels—but nearly all index-tracking funds don’t qualify. That’s because it’s hard for passive strategies to meet the FCA’s strict sustainability definitions.

So far, only 94 active funds (with £35bn in assets) have grabbed a label and 8 passive funds. ETFs are excluded as it only applies to UK domiciled funds.

Active ETFs still represent a tiny fraction of European ETF assets under management (AUM) – just 2.5% at the end of Q1, according to data from Morningstar Direct.

However, they have enjoyed a healthy and growing share of Europe-wide ETF demand in recent years, accounting for 7% of all inflows in 2024.

ETF share classes report

With so much interest around ETF share classes these days we decided to write a short report summarising the current state of play and why the big attraction for ETF share classes of mutual funds.

There’s a lot to like e.g.

- Broader distribution reach without launching separate funds

- Seamless performance history via shared track records

- Cost savings through consolidated infrastructure

- A more efficient path to market with minimal need for seed capital

- Enhanced scalability, enabling pricing improvements and better execution across asset bases

However the devil is always in the detail to check out the report to discover more.

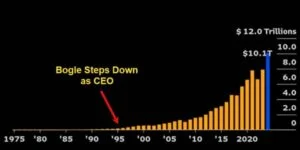

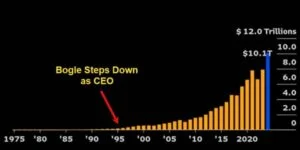

98% of Vanguards $10T in assets today came AFTER Jack Bogle stepped down as CEO. He ran the company for twenty years and got to $200b, which he thought was ginormous at the time. Look at it now.

Columbia Threadneedle is looking to enter the increasingly competitive European ETF market.

The company owned by Ameriprise Financial registered its Columbia Threadneedle ETF Icav with the Central Bank of Ireland last month, although investment strategies of individual subfunds have not been disclosed.

BlackRock is ordering senior managers to return to the office five days a week in the latest sign that large financial services groups are tightening their flexible working policies. The world’s largest asset manager is to tell staff as early as Thursday that its roughly 1,000 managing directors globally will be expected to work from the office full time.

This is a similar tactic deployed by JP Morgan, a passive aggressive strategy to get EVERYBODY back to the office full time. When your boss is in the office all the time, it cranks the pressure up on everyone else to return.

Goldman Sachs is to wind down its white-label ETF platform.The US lender will transfer servicing responsibilities for the $5bn of ETFs on the platform, which launched in November 2022, to Tidal Financial Group.

The two companies confirmed to Bloomberg that Tidal would take over the servicing responsibilities for two trusts with a total of 12 ETFs that were rolled out via the platform, which is known as ETF Accelerator.

Career corner

Movers and Shakers

Cboe Global Markets has appointed Craig Donohue as CEO, He was previously CEO of the Options Clearing Corporation.

Invesco Swiss head of institutional and wholesale distribution for ETFs Nima Pouyan has departed after eight and a half years at the firm. No news yet on his next destination.

On the Move

Looking to take the next step in your ETF career?

ETFcareer.com connects top talent with the industry’s leading firms. Whether you’re just starting out or seeking a senior-level role, our curated job board features opportunities tailored to your expertise.

Tip of the week

How to not look for a job

Recently someone sent me a message on LinkedIn. This was a completely random person whom I have never spoken to in my life before. What does someone expect by sending a message like this? For me it signals:

- This person is lazy

- Desperation

- This is a mass market message they have probably send to hundreds of people

Such an approach is never going to work, with ANYONE. So if you are in the position of looking for a new job, please do me a favour and don’t follow this script. It sucks.

Instead, take the time to craft a thoughtful, personalised message. Show genuine interest in the person’s work, highlight common ground, and explain clearly (and concisely) why you’re reaching out.

A little effort goes a long way — and in this industry, how you approach people is often your first impression. Make it count.

Fun Fact

The U.S. Secretary of Commerce Howard Lutnick says the ‘new model’ is factory jobs for life—for you, your kids, and your grandkids, that Gen Z could work in for the “rest” of their life there.

Hmm, I think Mr Lutnick might need to spend some time on TikTok to see what Gen Z would thing about that idea.

About us

Join the Blackwater Referral Program & Earn Rewards for Your Network

Unlock a simple way to generate extra income while helping professionals and businesses connect. By becoming an affiliate member of the Blackwater Referral Program, you can leverage your network and earn a percentage of our placement fees.

How It Works

- Refer a Candidate – If you introduce us to a job seeker who we successfully place, you’ll receive 5% of the fee earned.

- Refer a Company – If you connect us with a company that becomes a client, you’ll receive 10% of the fee earned.

It’s a win-win: you help expand opportunities, and we reward you for it. No effort, just rewards.

Start earning today – get in touch to learn more.