Does thy neighbour earn more than you? Find out here

We’re excited to launch our Global ETF Salary Survey for 2025 — the only industry-wide survey powered by a recruitment firm 100% focused on ETFs, globally.

Every year, this data helps professionals across the Global ETF Ecosystem benchmark where they really stand.

The more who take part, the better the insights.

How it works:

‣ Survey now open for 3 weeks

‣ Summary report will be made available for free to anyone who asks for it

‣ A more detailed report will be available to individuals for a small fee

‣ A very detailed report will be available to companies for a slightly bigger fee

So if you want to see how your compensation compares to peers across the ETF ecosystem then fill in the survey find and find out.

The Big Picture

Trump paused US tariffs… and markets lost their minds.

Last week was the financial equivalent of a Red Bull IV drip: US stocks staged one of their most historic rallies ever, with the S&P posting its best day since 2008, the Nasdaq flying to heights unseen since 2001, and the Dow clocking its strongest session since the Covid recovery. AND the badly beaten ‘Mag 7’ added a casual $1.5 trillion in value in the meantime.

Things were rosy midweek in Europe too: on Wednesday, Europe’s Stocks 600 rallied 2.7% in its first gain in five days following its worst week in five year and the UK’s FTSE 100 recovered 2.7%— its best day since March 2022 after falling to a one-year low

Safe-haven assets joined the rally party too— gold hit a new all time high and oil bounced off four-year lows. Meanwhile, currencies went wild: the US dollar dropped to a YTD low, while the euro and franc hit multi-year highs.

Here are the big stories from last week:

- Trump paused reciprocal US tariffs for 90 days, triggering a record-breaking US stock market rally that briefly restored investor confidence.

- But fears returned fast, as the US-China trade war reignited— with Europe caught in the geopolitical crossfire.

- Regulators are investigating Trump after he posted a ‘buy the dip’ message via his social media platforms just hours before the market’s historic rally, raising serious questions about market manipulation.

Launches this week

Flows & performance

ETF investors poured $36.3 billion into U.S.-listed ETFs during the week ending Friday, April 11, bringing year-to-date ETF inflows to more than $340 billion.

The flows came amid a week of extreme market volatility. On Wednesday, the S&P 500 surged 9.5%, its biggest one-day gain since 2008. The Nasdaq-100 did even better, jumping 12%—also its best day since the financial crisis. Meanwhile, bond yields soared, with the 10-year and 30-year Treasury yields shooting higher in a move that spooked policymakers and rattled investors.

Despite the turmoil, the S&P 500 ended the week well off its lows—more than 7% higher than Tuesday’s close, when the index had flirted with bear market territory—as hopes grew that President Donald Trump might ease off his escalating trade war.

Equity ETFs Lead Asset Class Flows

U.S. equity ETFs were the biggest beneficiaries of the rebound, pulling in $35.1 billion. That dwarfs flows into every other asset class. In contrast, international equity ETFs saw outflows of $2.8 billion, while U.S. fixed-income ETFs had modest inflows of $727 million.

Among individual ETFs, the SPDR S&P 500 ETF Trust (SPY) and the Vanguard S&P 500 ETF (VOO) led the pack, hauling in $19.3 billion and $11.3 billion, respectively.

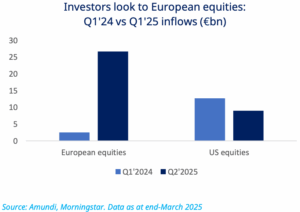

The equity rotation into Europe drove growth in the European UCITS ETF market in both the month of March and the first quarter of 2025.

ETF investors added €87.1bn in net new assets (NNA) in the quarter, up from the €46.2bn recorded in Q1 2024. The growth was largely driven by equities, which posted inflows of €71.5bn.

European equity ETF strategies led the way in the quarter, gathering €26.7bn as investors looked to Europe instead of US strategies, the latter of which accounted for €9.0bn of NNA in the quarter. This is in stark contrast to the first three months of 2024 when US equity ETFs gathered €12.7bn and European equities just €2.5bn.

Equity rotation into Europe

The equity rotation into Europe drove growth in the European UCITS ETF market in both the month of March and the first quarter of 2025.

ETF investors added €87.1bn in net new assets (NNA) in the quarter, up from the €46.2bn recorded in Q1 2024. The growth was largely driven by equities, which posted inflows of €71.5bn.

European equity ETF strategies led the way in the quarter, gathering €26.7bn as investors looked to Europe instead of US strategies, the latter of which accounted for €9.0bn of NNA in the quarter. This is in stark contrast to the first three months of 2024 when US equity ETFs gathered €12.7bn and European equities just €2.5bn.

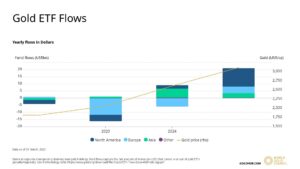

After four monthly inflows in a row, total AUM of global gold ETFs reached another month-end peak of US$345bn

Global physically backed gold ETFs reported strong inflows in March totalling US$8.6bn

JPMorgan, said first-quarter assets in its ETF business jumped 39% as inflows surged into its biggest funds, including JEPI and JEPQ.

ETF assets under management rose to $239.9 billion from $172.6 billion in the prior year’s first quarter with $19.1 billion in flows, a 30% jump from the year-earlier period.

Investors lost $25.7bn in leveraged exchange traded funds

Investors lost $25.7bn in leveraged exchange traded funds late last week, in the biggest ever meltdown for risky funds that have drawn huge inflows in recent years from retail traders seeking quick returns.

The biggest percentage loss was chalked up by the Ireland-based Leverage Shares 4x Long Semiconductors ETP, which haemorrhaged 59.1% over the two days, according to FactSet. Three other Leverage Shares ETFs — 5x Long Magnificent 7, 3x Boeing and 3x Arm — lost more than 50%. In dollar terms, the biggest loser among leveraged ETFs was the $20bn US-listed ProShares UltraPro QQQ, based on the technology-heavy Nasdaq index, which lost $6.3bn.

As global stock markets plunged in the wake of US President Donald Trump’s trade tariffs, Chinese state investment firms led daily net inflows of US$10.2bn into China’s equities ETFs on April 7 – the largest single day of inflows this year and among the highest ever.

The surge came as Central Huijin Investment, a sovereign wealth management arm under China’s State Council, stepped in to snap up ETF shares in a co-ordinated move to restore market confidence.

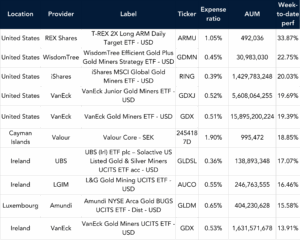

Best Performers US & EU

Listen and Learn

Today we sit down with Alex Graf, a driving force behind innovation in the advisor space. Alex shares why he left the traditional corporate world to build something more agile and how his team is now empowering advisors in ways that just weren’t possible a decade ago.

We dive into the importance of understanding your environment, leading with purpose, and why real impact starts with knowing your why.

Tune in to hear how Alex is helping redefine the game for modern financial advice – and what he wishes he knew earlier in his career.

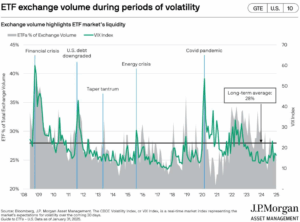

Graph of the Week

ETFs made up 43% of all equity trading in the US on April 7th, the second highest reading ever. Only time it was higher was Nov 2008.

Funds in Focus

Lazard Asset Management has joined the ETF party with a contribution of three actively managed ETFs – Equity Megatrends, Japanese Equity, and Next Gen Technologies. All are actively managed with a concentrated portfolio of 40-60 holdings and listed on Nasdaq. Looking at two of the three

The Lazard Equity Megatrends ETF (THMZ) has a net expense ratio of 50 basis points and seeks to dial in on global market trends that could pay off in the long-term. Following the identification process, THMZ then invests in a mix of themes that could potentially benefit from these trends.

The Lazard Next Gen Technologies ETF (TEKY) also has a net expense ratio of 50 basis points and its objective is to provide long-term portfolio growth with a focus on companies leading the way in hardware, automation, and artificial intelligence.

Things of interest

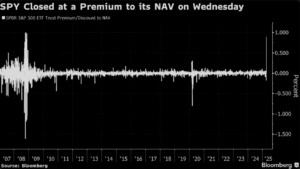

One of the largest ETFs in the world was left at the widest premium to its underlying holdings since 2008 at the end of Wednesday’s historic session. The $576 billion SPDR S&P 500 ETF Trust, or SPY, closed roughly 90 basis points above its net-asset value on a day when it surged 10.5% — the most in 16 years.

April 11, 2025 marks the 25th anniversary of the listing of the first ETFs in Europe. The LDRS DJ STOXX 50 and LDRS DJ EUROSTOXX 50 sponsored by Merrill Lynch were listed on 11 April, 2000 on the Deutsche Borse, closely followed by the listing of the iShares FTSE 100 ETF on the London Stock Exchange on April 28, 2000.

The LDRS ‘leaders’ were acquired by Barclays Global Investors from Merrill Lynch in September 2003 and their names were changed to iShares DJ STOXX 50 and iShares DJ EUROSTOXX 50.

China has been looking at allowing Western firms to act as market makers

China has been looking at allowing Western firms such as Citadel Securities and Jane Street to act as market makers in its rapidly growing ETF sector, two people with direct knowledge of the matter said.

Over the last two years, Chinese authorities have issued more licences and encouraged the development of domestic market makers. But international market makers are more experienced in providing liquidity to ETFs and the move would boost trading efficiency and lower costs. Citadel Securities, Jane Street and Optiver may be the first to benefit.

Chinese and Brazilian asset managers are moving closer to launching paired ETFs in respective markets after stock exchanges in the two markets confirmed they had agreed to roll out an ETF collaboration scheme.

The Shanghai and Shenzhen stock exchanges each signed memoranda of understanding about ETF connectivity co-operation with Brazil’s B3 exchange at the end of last month, according to statements from the Chinese bourses.

In its latest comments to asset managers applying for ETF share classes to be tacked onto their mutual funds, the SEC has asked applicants to follow Dimensional Fund Advisors’ (DFA) amended filing. Optimism over some form of approval surged after acting SEC chair Mark Uyeda said last month that the regulator is prioritizing a review of the applications.

Whilst the markets are volatile right now, the below puts things into perspective a bit i.e. we have seen worse

Career corner

Movers and Shakers

- Ed Rosenberg has joined Russell Investments as Head of ETF Product. He was previously Head of ETF & Fund Management at Texas Capital Bank.

- Dimitris Andreopoulos has joined Franklin Templeton in London as an ETF Portfolio Manager. He joins from MSCI.

- Frank Spiteri head of asset management at Coinshares has left the firm. No news next on his next destination

- Joe Mahoney has joined Hudson River Trading to take on an ETF Sales role. He joins from Old Mission.

- Brian Lomedico has joined Pacer ETF as a Managing Director. He joins from Amundi US

On the Move

Looking to take the next step in your ETF career?

ETFcareer.com connects top talent with the industry’s leading firms. Whether you’re just starting out or seeking a senior-level role, our curated job board features opportunities tailored to your expertise.

Tip of the week

Last week I had a conversation with a brilliant guy who found himself out of work and struggling to find a new role.

It’s a common scenario I come across where someone has always been in work, never had to interview and then one day BANG.

It’s a shock to the system.

Having walked this path myself, here is what I would do:

- Don’t panic, it might feel bad but honestly, it’s not the end of the world

- Start engaging your network hard, and if you don’t have a strong one, start building it

- Finding a new job is like a fulltime job in itself so treat it as such – focus on it

- Find a decent recruiter to work with. 99% of recruiters are idiots, have no clue about your circumstance and lack empathy, so choose wisely

- This might be the time to reassess your life and think about that entrepreneurial idea you always had in the back of your mind. Remember there’s more than one way to skin a cat

You might feel like you are in a hole right now but life throws us such curveballs. Tomorrow might be your day so keep the faith.

About us

Join the Blackwater Referral Program & Earn Rewards for Your Network

Unlock a simple way to generate extra income while helping professionals and businesses connect. By becoming an affiliate member of the Blackwater Referral Program, you can leverage your network and earn a percentage of our placement fees.

How It Works

- Refer a Candidate – If you introduce us to a job seeker who we successfully place, you’ll receive 5% of the fee earned.

- Refer a Company – If you connect us with a company that becomes a client, you’ll receive 10% of the fee earned.

It’s a win-win: you help expand opportunities, and we reward you for it. No effort, just rewards.

Start earning today – get in touch to learn more.