But lately, it feels less like healthy growth and more like a system under stress.

In the first nine months of 2025, nearly 800 ETFs launched in the US, already more than all of 2024. The pace points to over 1,000 new products by year-end. Many of these funds are niche, leveraged, or single-stock strategies. Some are being issued by smaller firms trying to find a foothold in an increasingly crowded market.

The problem is not demand, it’s infrastructure. There aren’t enough market makers to support this surge. Trading firms are signaling limits to how many funds they can quote. They’re becoming selective, prioritizing liquidity and scale.

That leaves smaller ETFs struggling to trade efficiently, often ignored by fund selectors who have too much product and too little time.

Whilst it’s has never been easier to launch a new ETF, the flip side is that having a successful launch is only getting more difficult.”

The ETF industry isn’t broken. Far from it. But it is starting to show signs of strain. The challenge now is not innovation, it’s discipline. We need products that genuinely solve investor problems and not simply chase the latest trend. Because if the current pace continues, the issue won’t be about which ETFs succeed. It will be about how many survive.

Retail traders are doubling down, gold is glowing and banks are breaking

– oh my!

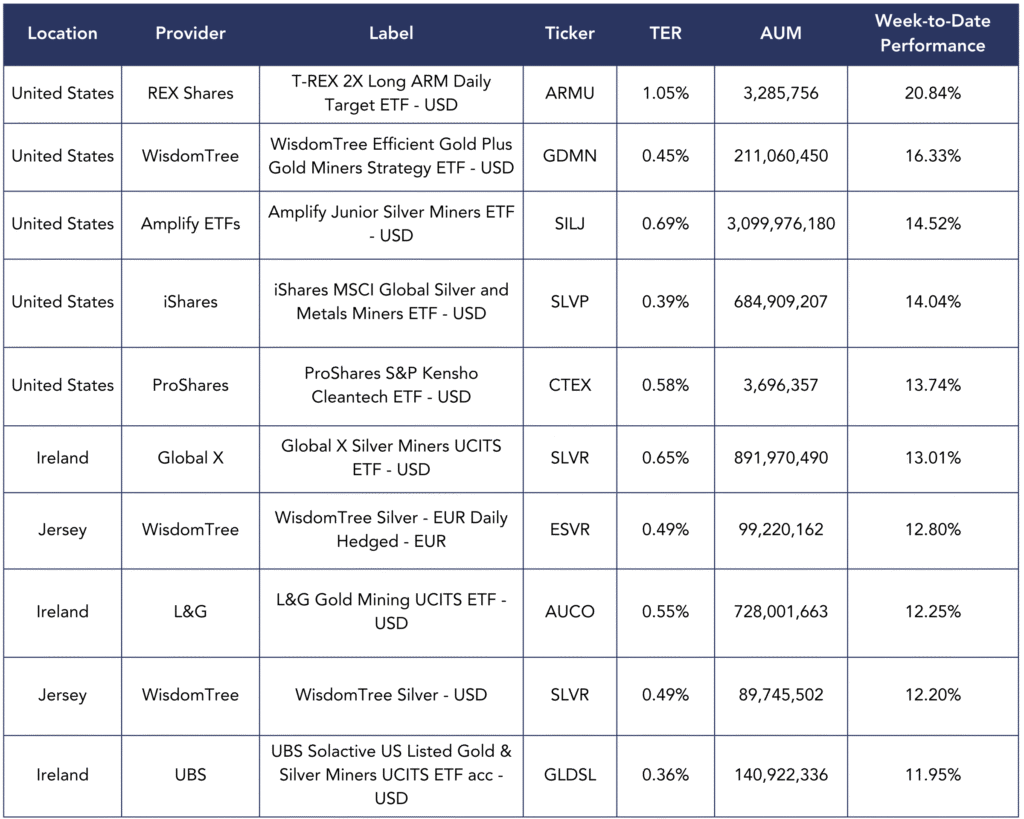

It was a mixed week across the global markets. Gold and silver rallied to new heights, oil dropped, and retail traders kept scooping up ETFs despite growing despite leveraged fund closures and lots of bubble talk. Meanwhile, Europe’s largest companies kicked off earnings season with strength… and regional US banks sent a shiver through credit markets.

Record High: Assets invested in the global ETFs industry reached a new all-time high of US$18.81 trillion at the end of September, surpassing the previous record of US$17.85 trillion set in August 2025.

Consistent Momentum: September 2025 marked the 76th consecutive month of net inflows.

(Source: ETFGI)

The biggest gold ETF in the world was launched in 2004. Since then, it’s outperformed the S&P 500. Wild!! (Source: Bloomberg)

Take a look at how the market making space in the US is dominated by a small few. If anything were to happen to any of those firms, then the house of cards could come falling down.

London-based hedge fund Man Group is “looking at” a European ETF platform as part of a major push into the wrapper, according to the firm’s global head of wealth.

After launching its first standalone ETFs in the US in September, the firms has described ETFs as “better technology” than the mutual fund.

Considering we have not seen a huge amount of hedge fund managers take much notice of the ETF space so far, this is certainly an interesting development. (Source: ETF Stream)

The Financial Times reports that Invesco’s flagship Invesco QQQ ETF (the US$385 billion fund tracking the Nasdaq 100) is the world’s most profitable ETF, generating about US$770 million in annual revenue.

Yet Invesco earns little from it because QQQ is structured as a “unit investment trust,” a 1990s relic that forces excess income to be spent on marketing rather than profit. Beneficiaries include Nasdaq, Bank of New York Mellon, and a long list of sports and cultural sponsorships worth roughly US$175 million a year.

Invesco is now seeking shareholder approval on October 24 to convert QQQ into a modern open-ended ETF, which would let it retain profits, reinvest dividends, and lend securities. Fees would drop slightly from 0.20% to 0.18%, with the marketing budget halved.

The change could transform QQQ into a far more lucrative product for Invesco and marks a pivotal moment for one of the ETF industry’s most successful funds.

The U.S. Securities and Exchange Commission (SEC) has said it was “unclear” whether the dozens of recent filings by asset managers to issue highly leveraged ETFs would be approved by the agency.

Since the U.S. government shutdown began, “the agency has received a large number of registration statements for ETFs seeking to offer 3x and 5x leveraged, equity-linked exposure,” said Brian Daly, director of the SEC’s division of investment management.

“It is unclear whether these ETFs would comply with the Derivatives Rule (Rule 18f-4), which generally limits leverage to 2x.”

Most recently, ETF issuer Volatility Shares filed to launch a total of 27 highly leveraged ETFs, including the first-ever proposed 5x ETF for the U.S. market, in a move that raised eyebrows amid widespread concerns over inflated asset prices.

The Brazilian ETF market is still relatively small but showing clear signs of momentum. As of October 2025 there were about 150 ETFs offered by ~15 providers, with total assets around US$13–14 billion.

By comparison Brazil’s broader mutual fund industry runs to roughly US$3 trillion—so ETFs have plenty of head-room.

Between August 2024 and July 2025, ETFs in Brazil received US$1.055 billion in net inflows, ranking second among fund categories in that period.

Also the number of accounts investing in ETFs reached 1.1 million by June 2025—a 29% increase over the prior 12-months. (Source: ETF Express)

JPMorgan Asset Management says it has uncovered untapped demand for active ETFs in south-east Asia through feeder fund tie-ups.

The US manager said that flows into active ETFs via feeder funds in Malaysia and Thailand accounted for over 70% of JPMorgan AM’s total net inflows to south-east Asia and India this year.

The strategies were attracting retail investors, as well as professional and institutional clients such as insurers and pensions. (Source: Ignite Asia)

The publication says the register of the Australian Securities & Investments Commission in September featured a new managed investment scheme named the iShares Bitcoin ETF, indicating that the world’s largest asset manager has filed for a local bitcoin ETF with the Australian regulator.

This was followed by the registration of a trustee for iShares bitcoin ETF on the Australian Business Register. (Source: Ignite Asia)

The ETF creation and redemption process is the mechanism that keeps an ETF’s market price closely aligned with the value of its underlying assets. It involves authorised participants (APs), typically large banks or trading firms, that can exchange baskets of securities for ETF shares directly with the issuer.

In the creation process, an AP delivers the underlying stocks or bonds to the ETF provider in exchange for new ETF shares, which it can then sell in the market. In redemption, the AP returns ETF shares to the issuer and receives the underlying securities back.

This in-kind exchange allows supply and demand in the ETF’s secondary market to stay balanced with the ETF’s net asset value. The result is a self-correcting system that maintains liquidity and price efficiency across the ETF market.

ETFcareer.com connects top talent with the industry’s leading firms. Whether you’re just starting out or seeking a senior-level role, our curated job board features opportunities tailored to your expertise.

Your career feels best and performs best when three things line up:

Take a few minutes to list your skills, interests, and employer priorities. Where they overlap is your career sweet spot, the work that energizes you and delivers the most value.

Example: You’re skilled in data analysis, love storytelling, and your firm values clear insights, focus on creating visual reports or dashboards.

Why it matters: working in your sweet spot improves engagement, reduces burnout, and helps you grow faster. Managers notice the results, and you spend more time doing work that actually matters.

Start small: identify one task this week that hits all three areas, and do more of that.

“Be more concerned with your character than your reputation, because your character is what you really are, while your reputation is merely what others think you are” – John Wooden

Unlock a simple way to generate extra income while helping professionals and businesses connect. By becoming an affiliate member of the Blackwater Referral Program, you can leverage your network and earn a percentage of our placement fees.

It’s a win-win: you help expand opportunities, and we reward you for it. No effort, just rewards.

Start earning today – get in touch to learn more.

Get exclusive access to in-depth reports, market trends, and curated ETF insights—delivered weekly. Built to help you stay sharp, without the noise.

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |