ETFs as we know them are dead. And here’s why.

The Central Bank of Ireland has approved the use of semi-transparent ETFs, marking a significant shift following sustained industry pressure.

This move is a clear win for issuers seeking to protect proprietary strategies.

However, it raises concerns for investors, who will now have less visibility into the holdings of the funds they buy.

Transparency has long been a cornerstone of the ETF structure.

The argument that full disclosure risks front-running or gives away “secret sauce” remains largely unsubstantiated.

This decision may help Ireland remain competitive with Luxembourg, but it also sets a precedent: investor clarity, once non-negotiable, is now optional.

The Big Picture

Markets were rattled last week with volatility picking up across equities, bonds, and FX.

A surprise rate cut from the ECB briefly lifted sentiment in Europe, but ongoing trade tensions and soft economic data kept investors on edge. In the U.S., cooler-than-expected inflation figures initially sparked hopes of a Fed pivot—but those were quickly drowned out by political noise, as Donald Trump escalated his attacks on Fed Chair Jay Powell, accusing him of stalling on rate cuts. The mix of macro uncertainty and political pressure left markets in risk-off mode by week’s end.

Here are the 3 big stories from last week:

- ECB Cuts Again – On April 17, the ECB lowered its deposit rate by 25bps to 2.25%—its seventh cut in a year—as it tries to shield the eurozone from growing trade tensions, especially around U.S. tariffs.

- Trump vs Powell (Again) – Trump ramped up his attacks on Fed Chair Jay Powell, calling him a “major loser” and slamming the Fed’s refusal to cut rates. The timing, just after the ECB move, reignited concerns over Fed independence.

- U.S. Inflation Eases – March CPI data showed a 0.1% drop, pulling annual inflation down to 2.4%. Core CPI ticked up slightly but overall, signs are pointing to cooling price pressures.

Launches this week

Flows & performance

ETF inflows in the US slowed dramatically during the week ending April 18, with just $2.9 billion of net new money entering U.S.-listed funds. That brought year-to-date inflows to $347 billion.

U.S. equity ETFs were the main source of weakness, posting $6.6 billion in outflows as investors braced for further volatility amid a 1.5% drop in the S&P 500. Inflows into international equity ETFs ($4.3 billion) and U.S. fixed-income ETFs ($4.1 billion) helped offset some of the damage.

Investor behaviour skewed sharply defensive. The SPDR Bloomberg 1-3 Month T-Bill ETF (BIL), the iShares 0-3 Month Treasury Bond ETF (SGOV), the Vanguard Short-Term Bond ETF (BSV) and the iShares Short Treasury Bond ETF (SHV) dominated the top inflows list, reflecting a flight to both short- and ultra-short-term bonds.

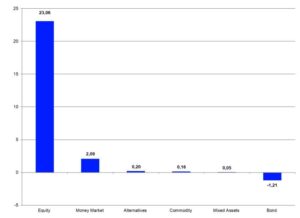

March 2025 was another month with strong inflows for the European ETF industry

Nevertheless, the performance of the underlying markets led, in combination with the estimated net flows, to decreasing assets under management (from €2,203.5 bn as of February 28, 2025, to €2,103.3 bn at the end of March.

The decrease in assets under management of €100.2 bn for March was driven by the performance of the underlying markets, which contributed (-€124.6 bn), while estimated net inflows added (+€24.4 bn), to the assets under management.

The inflows in the European ETF industry for March were once again driven by equity ETFs (+€23.1 bn), followed by money market ETFs (+€2.1 bn), alternatives ETFs (+€0.2 bn), commodities ETFs (+€0.2 bn), and mixed-assets ETFs (+€0.1 bn). On the other side of the table, bond ETFs (-€1.2 bn) were the only asset type facing outflows.

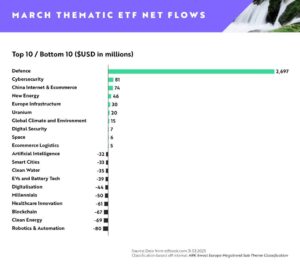

When it comes to Thematics, there’s only one show in town these days.

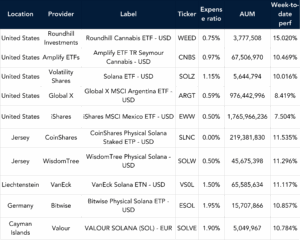

Best Performers US & EU

Listen and Learn

Will Cai, Global Head of Sales at Kaiko, joins Exchange Traded People to share his path into the world of ETFs and the growing potential he sees in crypto indexing.

He reflects on his early move to New York, a long tenure at JP Morgan, and how launching niche ETF products shaped his perspective on innovation. Will discusses why building benchmarks for digital assets is both a challenge and an opportunity-and what drove him to launch his own crypto ETF venture.

His biggest takeaway? Be patient. The right opportunities will come.

Graph of the Week

Bloomberg have launched a new Active vs Index report which shows how active management is doing in dozens of categories over several time frames. The 5 year numbers look ugly with only Small Growth, International Growth and Emerging being above 50%.

Funds in Focus

You can now get exposure to Iceland via the GlacierShares Nasdaq Iceland ETF (GLCR). Launched in partnership with Teucrium, GLCR provides investors with efficient access to Iceland’s equity market. The fund seeks to track the MarketVector™ Iceland Global Total Return Net Index, a rules based index designed to reflect the performance of Icelandic companies. It is priced at 0.95% and listed on Nasdaq.

But why Iceland?

- Abundant Resources – Iceland is rich in food and energy resources, supporting long-term economic expansion.

- Renewable Energy Leadership – Nearly 100% of electricity is generated from domestic renewable sources, making Iceland a global leader in sustainability.

- Political & Economic Stability – Ranked #1 on the Global Peace Index. Iceland offers a secure investment environment amid global uncertainty.

- Strategic Global Access – Independent from the EU but with direct access to the EU’s single market through the EEA. As a member of NATO, EFTA, and the Schengen Area, Iceland also maintains strong trade ties with both the U.S. and Europe.

Things of interest

Europe loves defence. In another copycat move, BNP Paribas, Amundi, BlackRock and Global X are all set to launch a European defence ETF. This follows in the footsteps of VanEck, WisdomTree and HANetf who are currently the market leaders in this space.

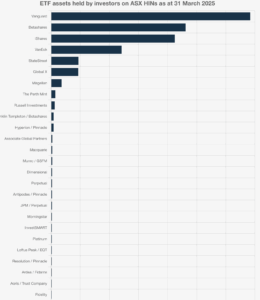

Active ETFs are failing in Australia, according to Stockspot. Most active managers who launch ETFs struggle to attract money. Today there are 50 ETF providers on the ASX, but just 11 of them control 97.5% of the assets. And all but three of those are index-focused.

That leaves the remaining 39 active ETF managers sharing just 2.5% of the ETF market between them. 24 ETF managers each manage less than $100 million — barely enough to stay afloat.

Conversions of SMAs to ETFs are growing in the US

Cerulli’s latest research highlights a growing shift among financial advisors toward using ETFs as a tax-efficient alternative to separately managed accounts (SMAs), especially for high-net-worth clients.

Since 2017, the share of HNW-focused practices offering tax planning has jumped from 29% to 45%, with tax minimization now ranking as a top client priority alongside wealth preservation. ETFs not only offer tax advantages but also address key operational challenges, allowing for streamlined execution and significant cost savings.

While SMA assets total $2.7 trillion—primarily in wirehouses—advisors already heavily favor ETFs, with 90% using them compared to just 45% for SMAs. The opportunity to convert SMA assets into ETFs is growing, particularly among large practices, but Cerulli notes that launch costs and scale requirements remain major hurdles. This creates room for white-label providers and ETF issuers to step in and support firms exploring these conversions.

Franco-German fund house Oddo BHF Asset Management is the latest European player to consider a push into the region’s growing active ETF space. Their CEO is quoted as saying “”Our clients tell us that there is now only one legal structure for funds […] and we have to deliver what clients want”

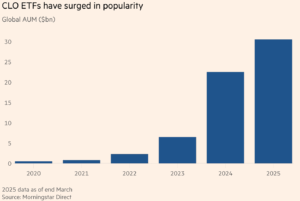

CLO ETFs have exploded in popularity over the past couple of years, with aggregate assets across the handful of funds surging to $30bn — about 13 times the $2.3bn they held at the end of 2022 — as investors lapped up their punchy yields. About half of it has gone into Janus Henderson’s JAAA ETF alone, which invests in the top-notch triple-A rated slices of CLO.

Large fund firms in China see enhanced ETFs as a gateway

A gateway to launching active ETFs in the future, as they look to differentiate their product offerings in an increasingly crowded passive funds market.

Harvest Fund Management, E Fund Management, Yinhua Fund Management and Maxwealth Fund Management have recently submitted filings for the first batch of Star Market Composite Index Enhanced Strategy ETFs to the China Securities Regulatory Commission, according to the Cailian Press.

The filings, made between April 11 and 15, come just months after the Star Composite Price Index was officially launched in January and signal growing interest in combining passive investing with alpha-generating enhancements.

AQR Capital Management has issued a critical assessment of Buffered ETFs. According to Bloomberg, the Connecticut-based quant manager argues that these buffer or defined-outcome strategies, which have amassed approximately $50 billion in ETF assets, offer lower returns with increased risk compared to simpler alternatives.

After analyzing 99 strategies using Morningstar Inc. data, AQR found that most of these allocation styles underperformed traditional portfolios over the past five years. Specifically, only 14% of the funds examined outperformed a straightforward strategy of investing in a passive ETF tracking the S&P 500, combined with three-month Treasury bills.

Career corner

Movers and Shakers

- Patrick Rista has joined Westwood Holdings Group as an ETF Specialist. He joins from Strategas Asse Management.

- Jay Jacobs has been promoted to Head of US Equity ETFs at BlackRock

On the Move

Looking to take the next step in your ETF career?

ETFcareer.com connects top talent with the industry’s leading firms. Whether you’re just starting out or seeking a senior-level role, our curated job board features opportunities tailored to your expertise.

Tip of the week

Here’s what I told him

An ex-colleague of mine reached out to me the other day saying he had recently been made redundant and finds himself in the unlikely position of looking for a job for the first time in 25 years. Here’s what I told him.

You’re not starting from scratch—you’re starting from experience. But the game has changed, so here’s how to get back in:

Update your LinkedIn. People will look. Give them something solid to read.

Craft your story. Be ready to explain the value you’ve added over the years—not just your job titles.

Take the interview—even if it’s not your dream job. Practice makes perfect. Every rep helps.

Start sharing your CV. Just don’t be shocked if the help doesn’t come from who you expect. It’s often the least likely contact who opens the right door.

About us

Join the Blackwater Referral Program & Earn Rewards for Your Network

Unlock a simple way to generate extra income while helping professionals and businesses connect. By becoming an affiliate member of the Blackwater Referral Program, you can leverage your network and earn a percentage of our placement fees.

How It Works

- Refer a Candidate – If you introduce us to a job seeker who we successfully place, you’ll receive 5% of the fee earned.

- Refer a Company – If you connect us with a company that becomes a client, you’ll receive 10% of the fee earned.

It’s a win-win: you help expand opportunities, and we reward you for it. No effort, just rewards.

Start earning today – get in touch to learn more.