Active ETFs Are Old News—Here’s What Might Actually Change the Game

Active ETFs were once the disruptors.

Now, they’re firmly established.

Attention is shifting to ETF share classes, with recent SEC developments paving the way for broader adoption.

Meanwhile, private assets are the new kid on the block. Larry Fink’s most recent annual letter was all about unlocking private markets so yeah, safe to say the world’s biggest asset manager is VERY into this trend.

The question now is: which of these trends will truly reshape the ETF landscape and scale with investors in a meaningful way?

Time — and traction — will tell.

The Big Picture

Stocks rallied (thank goodness), Buffett retired (kinda), and TikTok may just survive its US ban (for now).

It was another big week across global markets: US stocks jumped on Friday, capping a second-straight weekly win as a strong jobs report eased recession fears on both Wall Street and Main Street.

The S&P 500 extended its rally to nine days, its best streak in two decades, while UK’s FTSE 100 logged a record 15-day win streak. Bitcoin broke a 10-week high, oil dropped to its lowest since 2021, and Europe prepped for rate cuts as inflation inches down throughout the region.

Here are the big stories from last week:

- During the Berkshire Hathaway annual shareholder meeting in Nebraska this weekend, legendary investor Warren Buffett, “The Oracle of Omaha”, announced his retirement at the end of the year— handing the reins to longtime successor Greg Abel who will oversee (and maybe allocate) Berkshire’s jaw-dropping $400 billion in cash reserves.

- President Trump softened his stance with two known enemies: in an interview last week, The Don said he would not fire US Fed Chair Jerome Powell (that’s ‘JPow’ to you) and would also extend the TikTok ban if its parent company meets the latest divestment deadline, claiming that he has “a little sweet spot in his heart” for the app.

- ETF investor darling VOO (Vanguard’s S&P 500 fund) officially became the world’s largest ETF, soaking up $21 billion in April alone— a monthly record in its 15 year history— as investors pile back into passive equity exposure, with year-to-date inflows totalling $55 billion.

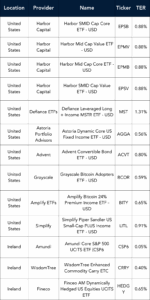

Launches this week

Flows & performance

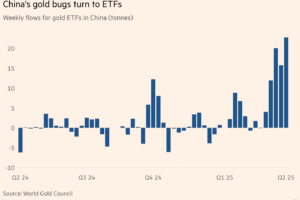

Chinese investors are piling into gold funds at a record rate. Inflows into gold ETFs in China total 70 tonnes — or about $7.4bn — this month, more than double the previous monthly record, according to the World Gold Council.

“Whilst we have seen ETF demand from other regions, China is really in the lead now,” said John Reade, senior market strategist at the WGC, adding Chinese investment demand for the precious metal had risen “dramatically” this month.

The country’s share of global gold ETF holdings has jumped to 6 % up from 3% at the start of this year, while over the past four weeks Chinese demand accounted for more than half of global gold ETF inflows.

A slowdown in ETF adoption threatens State Street Global Advisors’ (STT) full-year forecast of $1.3 trillion of inflows, according to the firm’s latest “US-Listed ETF Flash Flows” report.

Exchange-traded funds recorded $62 billion of inflows in April, marking the lowest monthly total in a year as investors retreated from riskier assets amid mounting volatility from escalating trade tensions.

- Gold ETFs had $3.8 billion of inflows (10 th all-time).

- Equities had just $32 billion of inflows (40th all-time); the bias toward the US remained despite returns favoring the rest of the world. Sectors had their worst month of outflows (-$11 billion).

- Bond ETF flows were muted (+$13 billion). The record $15 billion out of credit sectors was partially offset by ultra-short and short-term-government bond ETFs second-best ever inflow (+$19 billion). Inflation-linked bond ETFs added $1 billion

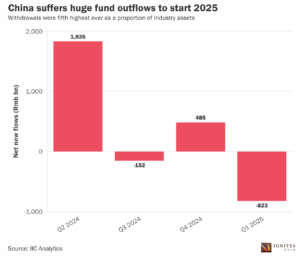

According to ICC Analytics Fund flows in China suffered their fifth ever largest net withdrawals as a proportion of assets in Q1. Included in this were passive funds.

The research firm said investor redemptions from passive products represented the largest quarterly organic outflows since the second quarter of 2020.

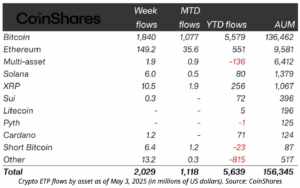

Cryptocurrency investment products attracted $2 billion in new inflows last week, according to the European investment firm CoinShares.

Global crypto exchange-traded products (ETPs) have added $5.5 billion in inflows in the past three weeks, according to the latest weekly report from CoinShares.

With the new inflows, total assets under management (AUM) in all crypto ETPs worldwide jumped 3.3% from $151 billion to $156 billion.

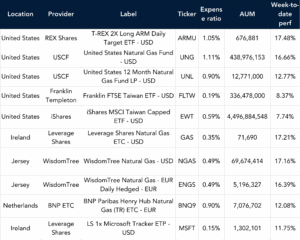

Best Performers US & EU

Listen and Learn

Looking Back: A Standout Episode of Exchange Traded People

This week, we’re revisiting one of our favourite episodes featuring Olivier Paquier, Head of ETF Sales at AXA Investment Managers. Olivier opens up about how networking shaped his path in the ETF world—and why it’s still one of the most undervalued skills in the industry.

If you missed it the first time (or need a refresher), now’s the perfect time to tune in.

Graph of the Week

Gold is currently the world’s largest asset, valued at over $21.7 trillion. In comparison, Bitcoin’s market capitalization sits at $1.9 trillion, making it the seventh-largest asset globally.

Funds in Focus

In recent years, ETFs utilizing options overlay strategies to generate income have experienced a significant rise in popularity among U.S. investors, particularly in a low-yield and volatile market environment.

These strategies, which often involve writing covered calls or using derivatives to enhance cash flow, have resonated with income-focused investors seeking alternatives to traditional fixed income.

Leading this trend is the JPMorgan Equity Premium Income ETF (JEPI), widely regarded as the posterchild product in this category. With its consistent monthly distributions and focus on lower-volatility U.S. large-cap equities, JEPI has attracted substantial assets and attention, establishing itself as a benchmark for income-generating equity strategies in the ETF market.

Since launch, JEPI has ballooned to nearly $39 billion in AUM and has returned approximately 70%, JEPI uses equity-linked notes (ELNs) to replicate a covered call strategy on the S&P 500, allocating up to 20% of its portfolio to ELNs, while the rest is invested in a basket of low-volatility, value-oriented U.S. stocks.

The fund has a TER OF 0.35% and is listed on NYSE.

Things of interest

Allfunds is eyeing the launch of its white-label exchange-traded product (ETP) platform in Q4 as it aims to capitalise on the growth of Europe’s active ETF market.

In the firm’s Q1 trading update, Allfunds said its ETP platform is “on track” to launch in Q4 this year, adding the platform will soon enter a testing phase.

The US Securities and Exchange Commission (SEC) has postponed deciding on whether to greenlight two proposed cryptocurrency exchange-traded funds (ETFs) holding Dogecoin and XRP, filings show.

The US regulator has delayed its deadline for ruling on the proposed ETF listings until June.

Bitcoin’s “base case” for the end of 2025 is $200,000 without further government adoption. Bitcoin’s expanding institutional adoption may provide the “structural” inflows necessary to surpass gold’s market capitalization and push its price beyond $1 million by 2029, according to Bitwise’s head of European research, André Dragosch.

The CEO of DWS has said he remained “sceptical” about launching private markets ETFs. “Conceptually, we could do [it], we have the capabilities of doing it. But I personally remain sceptical of mixing, by nature, illiquid private market assets that are not marked to market on a daily basis with an ETF that comes with a promise of daily liquidity”

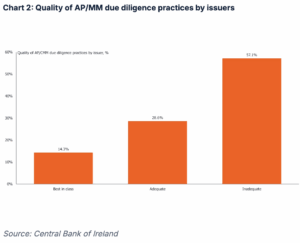

ETF Boards in Europe are under attack from the Irish regulator, the CBI. According to an analysis from ETF Stream, 57% of ETF issuer due diligence of APs and MMs is ‘inadequate’ by the regulators standards.

Issuers also scored poorly on the question of board oversight of liquidity providers with 43% classed as having inadequate practices.

Career corner

Movers and Shakers

- UBS Asset Management head of UK ETF and index fund sales James Collyer has departed eight months after entering the role to pursue a new opportunity.

- Mirza Ali Shakir has joined GSAM in NY as an Equity ETF Portfolio Management. He joins from BMO in Canada.

- Brian Szitanko has joined Global X in the US as Regional Director Great Lakes. He joins from Resolute Investment Managers.

- Ryan Ortega has joined US Bank as an ETF Relationship Manager in Boston. He joins from JP Morgan.

On the Move

Looking to take the next step in your ETF career?

ETFcareer.com connects top talent with the industry’s leading firms. Whether you’re just starting out or seeking a senior-level role, our curated job board features opportunities tailored to your expertise.

Tip of the week

The #1 Career Mistake People Still Make

It’s not the comp.

It’s not the brand name.

It’s not even the job title.

It’s ignoring culture fit.

You can land the “dream” role — but if the way they work doesn’t align with how you thrive, you’ll end up frustrated, burnt out, or gone before the year’s out. Most people ask about salary, tech stacks, and WFH policy.

Fewer ask: Do I actually like how this team operates?

Culture fit isn’t a bonus. It’s the foundation. Without it, everything else falls apart. Before you say yes, ask yourself: “Do I really want to work like this, with these people, on this mission?”

The wrong environment makes the right person feel wrong. Every time.

Fun Fact

Sell in May, go away: Wall Street isn’t buying it this year

The old Wall Street saying “Sell in May and go away” is being reconsidered this year. So far, market dynamics have been anything but typical. Sticky inflation, continued interest rate uncertainty, and AI-fueled tech gains have created a more erratic environment.

Some analysts argue that with today’s hyper-connected markets and retail trading activity, seasonal patterns like this one are increasingly irrelevant — or at least less reliable.

In short: what worked in the ‘90s doesn’t necessarily work in an algorithmic, meme-driven, FOMC-fixated market.

About us

Join the Blackwater Referral Program & Earn Rewards for Your Network

Unlock a simple way to generate extra income while helping professionals and businesses connect. By becoming an affiliate member of the Blackwater Referral Program, you can leverage your network and earn a percentage of our placement fees.

How It Works

- Refer a Candidate – If you introduce us to a job seeker who we successfully place, you’ll receive 5% of the fee earned.

- Refer a Company – If you connect us with a company that becomes a client, you’ll receive 10% of the fee earned.

It’s a win-win: you help expand opportunities, and we reward you for it. No effort, just rewards.

Start earning today – get in touch to learn more.